The Ripple-backed altcoin, XRP, at present is witnessing a light pullback and thus is priced round $2.23 after going nearly 1.5% down. Whereas bigger cryptocurrency market are in consolidation part, it appears as if the worth motion of XRP value is getting exhausted slightly below the essential 0.5 Fibonacci stage of $2.5444. This current rejection close to this Fibonacci implies that bears are suffocating final breaths of the bulls-in try and impale the costs beneath.

XRP Worth Evaluation

On every day charts, the token, earlier this month, had performed a breakout out of a falling wedge and rallied to $2.60, an area excessive. However the going up had stopped anytime close to the 50% Fibonacci retracement stage. Now the altcoin is heading for the 0.236 Fib stage at $2.1455, which is important help and coincides with the short-term 20-day and 50-day EMA at $2.26 and $2.57 respectively. Beneath this area, the 100-day and 200-day EMA at $2.09 and $2.00 may start to behave as a help if bearish strain intensifies.

By way of momentum, the MACD is displaying preliminary indicators of a bearish crossover because the MACD line has barely dipped beneath the sign.The rising uncertainty means there might be draw back momentum have been patrons to fail to uphold this help zone.

There is usually a bullish reversal from $2.14-$2.20 to $2.60-$2.76 if XRP value consolidates above this vary and doesn’t shut beneath the important thing EMAs; in any other case, the break beneath the 0.236 Fib will take the coin again towards that psychological $2.00 stage and perhaps even additional down.

XRP Derivatives

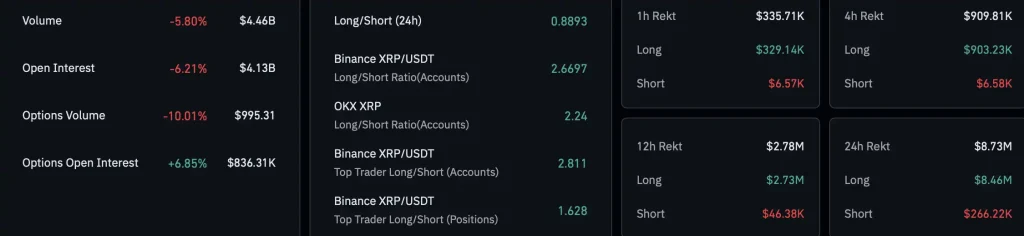

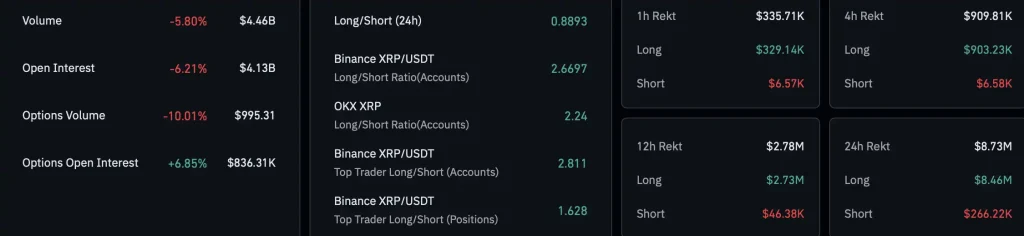

Indicators of bearish sentiment have gotten evident in derivatives markets. Coinglass information exhibits XRP’s clock-wise buying and selling quantity fell by 5.8% to $4.46 billion, whereas open curiosity fell by 6.21% to $4.13 billion. Whereas choices open curiosity went up by 6.85%, the general choices quantity shrank by 10%. The lengthy/brief ratio went beneath 1 to 0.8893 of late, portraying a shift in sentiment with extra merchants presently shorting XRP versus lengthy.

Additionally, liquidation information exhibits an $8.73 million value of long-position liquidation within the final 24 hours-about 97% of whole liquidations-giving $266k for shorts. Such a skew fortifies the capitulation narrative for over-leveraged bulls, driving the market right into a defensive posture.