Key Takeaways:

- XRP Ledger’s 2025 roadmap focuses on institutional DeFi and RWA integration.

- Key options embody permissioned DEX, credit-based lending, and versatile token requirements.

- Phased roll-out throughout the yr demonstrates a dedication to iterative growth.

Ripple Labs is making a daring push to dominate the institutional DeFi house with the launch of a brand new roadmap for the XRP Ledger (XRPL). The roadmap, printed on February twenty fifth on Ripple’s official web site, highlights key initiatives that focus on monetary establishments in quest of safe and compliant options based mostly on blockchain. This transfer marks a steady evolution of XRP Ledger, positioning it to be a middle for regulated monetary purposes that harness the immense potential of DeFi. The hassle, named “RippleX – XRPL Characteristic Proposals 2025,” outlines an in depth rollout timeline for these formidable options all year long.

Laying the Basis: Core Pillars of XRP Ledger’s Institutional DeFi Technique & Phased Rollout

XRPL’s 2025 Roadmap: Pioneering Institutional DeFi

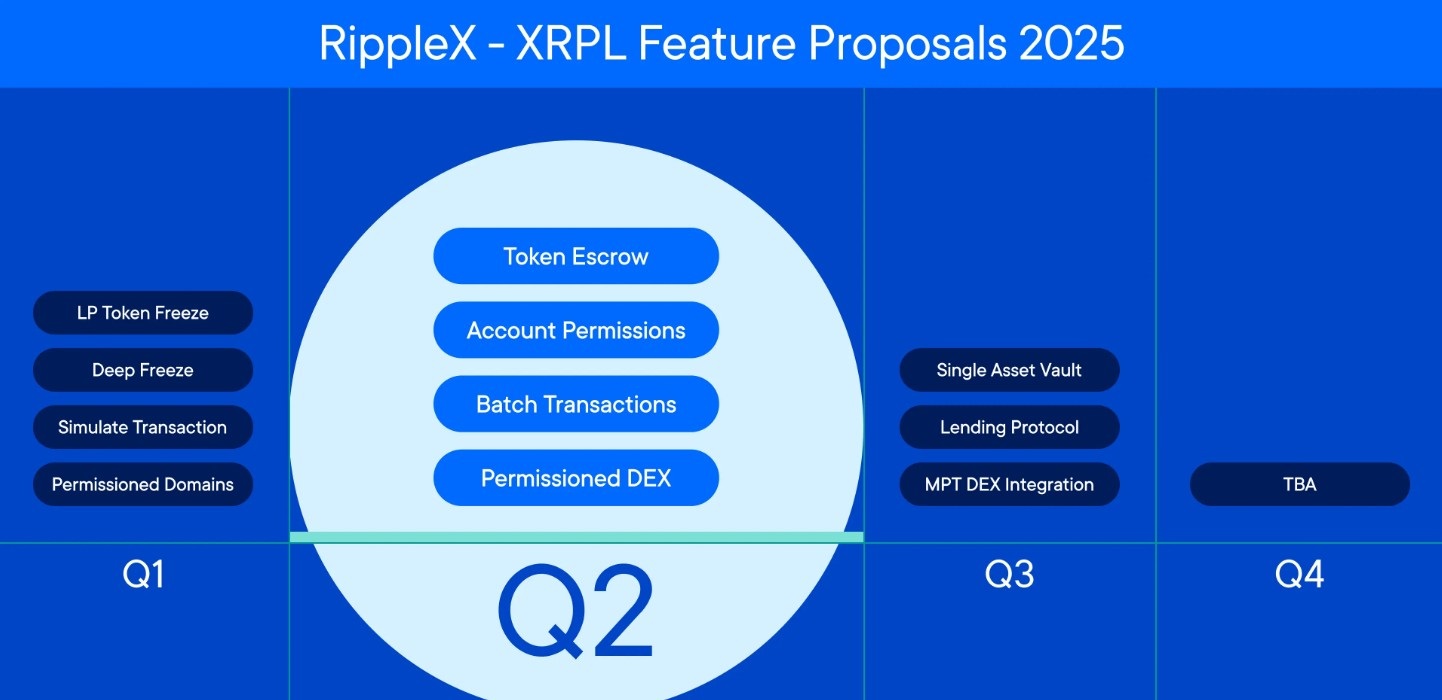

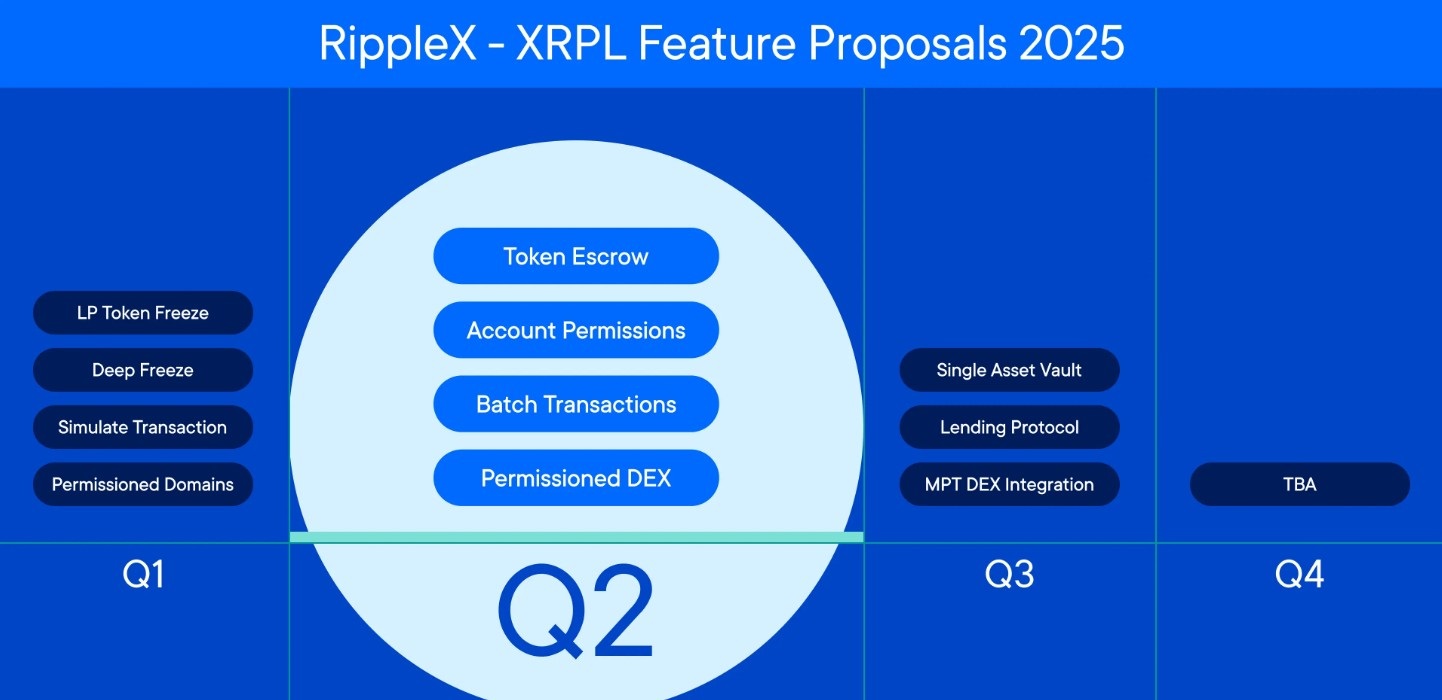

The roadmap is centered round a number of key components, every tailor-made to satisfy the collective wants and regulatory concerns of institutional gamers, with phases rolled out throughout particular person quarters in 2025:

Q1 2025: Infrastructure for Management & Safety

- LP Token Freeze: This selection permits the freezing of Liquidity Supplier (LP) tokens for additional management over liquidity swimming pools. The latter is vital for managed environments, the place consumer entry must be managed, and illicit actions want to be thwarted.

- Deep Freeze: Going a step additional, “Deep Freeze” probably presents a mechanism to utterly freeze particular accounts or belongings, offering a final resort in instances of safety breaches or regulatory non-compliance.

- Simulate Transaction: That is a vital characteristic for establishments, simulating a transaction with out truly writing to the reside blockchain. This reduces danger and maintains compliance.

- Permissioned Domains: Guaranteeing managed entry to blockchain environments.

Q2 2025: Privateness and Management

- Token Escrow: A permissioned DEX will implement compliance checks on the sensible contract degree, making a safe and extremely regulated surroundings for institutional buying and selling. Token escrow service offers an extra layer of safety by holding or segregating the tokens till the required circumstances are met.

- Account Permissions: Establishments want absolute management over who accesses the accounts. This most likely means fine-grained permission administration for various account operations, catering to strict auditing and compliance necessities.

- Batch Transactions: Improves effectivity by enabling a number of transactions to be bundled into 1 operation. A vital characteristic for the high-volume buying and selling use instances prevalent in institutional finance.

- Permissioned DEX: This ensures that each transaction is compliant — an important high quality for establishments which might be cautious about coping with conventional, less-regulated DeFi.

Q3 2025: Increasing XRPL’s Capabilities

- Single Asset Vault: A lending surroundings the place solely a single asset kind is accepted. An essential element for establishments requiring directed funding publicity.

- Lending Protocol: Designed to include compliance measures straight into the protocol, aiming for a clear and safe lending surroundings.

- MPT Dex Integration: Enabling the ledger to help Multi-Function Tokens.

This fall 2025: TBA

- TBA: Particulars on the ultimate section will likely be introduced later.

Such purposes will use XRP Ledger’s decentralized identifiers (DIDs) to embed regulatory compliance straight into sensible contracts on the core degree. Such a cautious strategy to compliance has develop into a trademark of Ripple’s philosophy and a distinction to extra permissive DeFi constructions that attraction to establishments on the lookout for a extra palatable entry level into the decentralized finance world.

XRP Ledger vs Ethereum: Who Will Be The DeFi Champion?

To this point, XRP Ledger has a strong and mature blockchain however nonetheless lags considerably behind Ethereum by way of TVL. In line with DefiLlama knowledge, as of February twenty sixth, XRP Ledger’s TVL is round $80M, whereas Ethereum TVL is hovering round $50B — these figures counsel an enormous disparity. This imbalance illustrates a vital dilemma dealing with XRP Ledger: drawing within the quantity and growth assets required to compete with present DeFi ecosystems.

Moreover, XRP Ledger has lacked open sensible contract deployment, a key driver of Ethereum’s progress. In distinction, the place builders can construct and deploy purposes freely on Ethereum and Solana, the XRP Ledger’s DeFi ecosystem has primarily been curated by its core growth group at Ripple. This construction, for all its benefits of management and safety has arguably smothered innovation and restricted the scope and variety of purposes on the platform.

This may very well be a defining second for XRP Ledger, as Ripple’s new DeFi roadmap goals to drive important progress. Ripple’s new DeFi roadmap is designed to draw new liquidity and developer curiosity to the XRP Ledger ecosystem by addressing institutional wants and regulatory concerns. The brand new EVM sidechain, as a result of go reside on mainnet in Q2 2025 will encourage extra builders to construct on the community. It goals to onboard builders from the EVM ecosystem into the XRPL framework by offering help for protocols that aren’t doable on XRPL legacy infrastructure, which might deliver a lot broader visibility to the XRPL ecosystem. Any transaction on this community – together with all monetary purposes – will likely be paid for in XRP, which can develop into the principal token for this goal.

Cost to Victory: Actual-World Belongings and the $30 Trillion Alternative

Tokenization of real-world belongings (RWAs) has develop into a cornerstone of XRP Ledger’s institutional DeFi push. In line with Ripple, with an estimated world price of $30 trillion, the RWA market might present one of the best shot the community has at realizing huge progress.

Tokenization of the true world means inserting some kind of asset (actual property, commodities, and even mental property) as a digital token on the blockchain. The advantages of tokenization embody improved liquidity, fractional possession alternatives, and simplified switch processes, amongst many others.

In a current interview, Polygon’s world head of institutional capital, Colin Butler, highlighted the immense potential of RWA tokenization. He pointed to the booming institutional curiosity on this sector and prompt that blockchain tech might utterly redefine the way in which conventional belongings are managed and traded.

One instance comes from actual property, which permits fractional possession, permitting extra buyers to take part while not having to buy whole properties outright. Its tokens can then be traded on a secondary market, enabling property house owners to have liquidity and unlocking novel funding alternatives. There are already corporations like RealT concerned within the strategy of tokenizing actual property, the place buyers can purchase fractions of properties, obtain rental earnings in cryptocurrency, and get full possession transferred to their accounts.

The Trump Impact: Driving a Wave of Regulatory Shifts and ETF Optimism

XRP Ledger’s success in institutional DeFi might hinge on the evolving political panorama in america. A brand new sense of optimism has been injected into the {industry}, with the rise of crypto-friendly politicians such as Donald Trump, who promised to show the U.S. into the “world’s crypto capital.”

Trump has made a variety of guarantees, corresponding to populating key monetary regulatory roles with industry-friendly leaders (and that the SEC can be no totally different), which has performed into hypothesis that the regulatory surroundings for cryptocurrencies may very well be extra beneficial going ahead.

A number of asset managers have moved to file purposes for U.S. listings for XRP exchange-traded funds (ETFs) with JPMorgan analysts projecting billions of {dollars} in buyers’ inflows stemming from them, thereby boosting demand for XRP.

Ripple has been coping with the SEC lawsuit since 2022, a lingering problem that continues to impression XRP. Nevertheless, some specialists have stated the case might be placed on maintain and even dropped below a Trump administration. The SEC’s determination to shut its investigation into Uniswap, a decentralized change, lately — one thing that would have an effect on how its crypto-market coverage develops sooner or later — alerts a possible change in how the regulator will take care of the crypto {industry}.

Tokens and Permissions: Expanded Performance

Ripple is increasing the XRP Ledger’s performance with versatile tokens, which signify belongings starting from bonds to collectibles. Additionally they have supplemental data to make them extra helpful, notably to institutional buyers. This eliminates the necessity for intermediaries — not simply banks, however different third-party intermediaries which may be required for lending, and as a substitute permit corporations to borrow and lend straight on the XRP Ledger with a quicker, extra seamless course of designed with security and regulatory compliance in thoughts.

Corporations can set permission settings for who can use sure options, guaranteeing privateness and safety in addition to aligning with authorized requirements and safeguarding delicate monetary actions.

Extra Information: Brazil Makes Historical past: First XRP Spot ETF Passes, Native Financial institution Seeks XRPL Stablecoin

The Highway Forward: Strengthening XRP Ledger’s Institutional DeFi Presence

Ripple’s shift to institutional DeFi and RWA tokenization is about to reshape the XRP ecosystem. XRP Ledger has the chance to develop into a unifier of tokenized belongings, working with rising laws to create a extra clear and safe monetary panorama.

However there could also be new challenges forward. The DeFi house is extraordinarily aggressive, and Ripple should present proof of idea for its DeFi and tokenization options to take a bigger share of the institutional market. For attracting institutional capital and restoring investor confidence, overcoming the destructive publicity that’s nonetheless surrounding the continuing SEC lawsuit is much more essential. Though formidable, the multi-quarter, iterative roll out plan would suggest that Ripple understands that execution would be the key to reaching what they’re after.