The US Division of Justice has seized 127,195 Bitcoin (BTC) linked to Chen Zhi, the alleged operator of a large “pig butchering” rip-off primarily based in Cambodia. The worth of the seized Bitcoin—round $15 billion—marks the biggest forfeiture motion within the DOJ’s historical past, underscoring the size of world crypto-related monetary crimes and the US authorities’s rising function in monitoring and recovering digital property.

The indictment towards Chen Zhi was unsealed this week in federal courtroom in Brooklyn, New York, revealing particulars of a posh worldwide fraud operation that focused 1000’s of victims worldwide by way of refined funding scams. Prosecutors allege that Chen and his associates laundered billions in stolen funds by way of cryptocurrency exchanges and shell corporations earlier than the property have been traced and frozen.

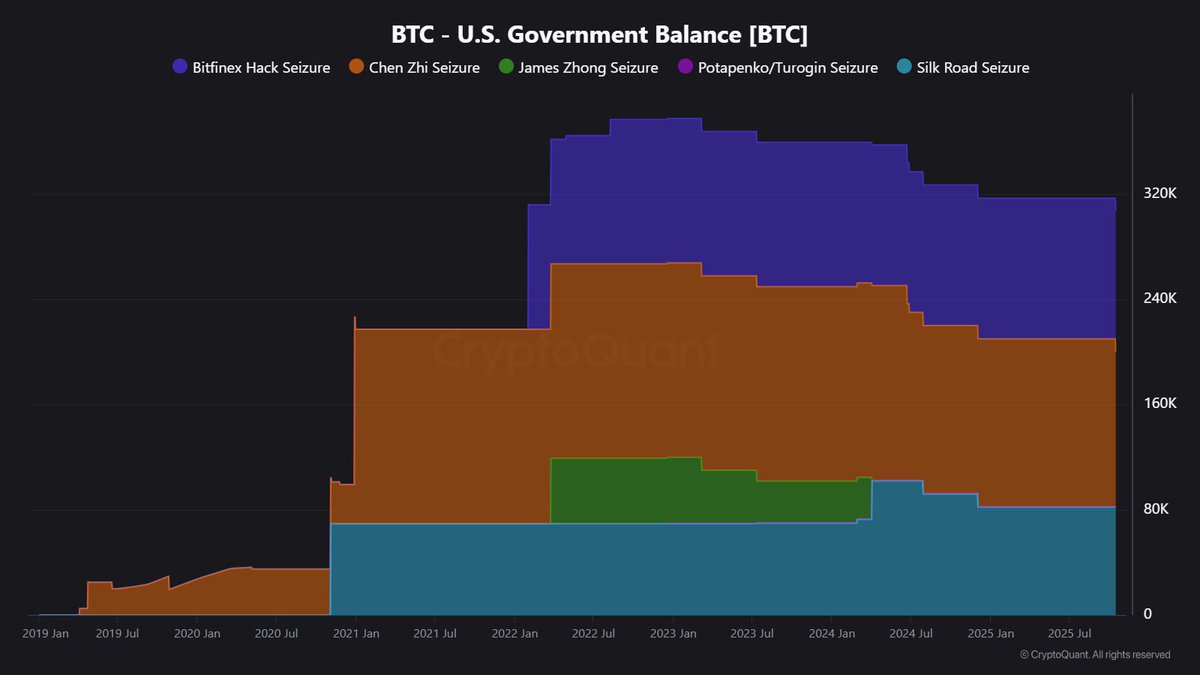

This newest seizure provides to the already vital Bitcoin reserves held by the US authorities from previous enforcement actions, together with these tied to the Silk Highway, Bitfinex hack, and different main circumstances. In complete, US holdings now exceed 316,000 BTC, valued at almost $36 billion at present costs, making the federal government one of many largest Bitcoin holders globally.

US Authorities’s Bitcoin Holdings Develop After Historic Seizure

CryptoQuant experiences that the US authorities now controls 316,760 BTC, price roughly $35.9 billion, following its newest seizure from Chen Zhi’s “pig butchering” rip-off. The 127,195 BTC confiscated on this case alone—at present valued at $13.2 billion—marks the biggest single Bitcoin seizure ever performed by the Division of Justice. At Bitcoin’s peak earlier this yr, those self same holdings have been price round $15.5 billion.

This operation cements the US as one of many largest identified Bitcoin holders, with its pockets comprising property from a number of main regulation enforcement actions over the previous decade. Probably the most vital elements embody:

Bitfinex Hack (2016) — Regulation enforcement recovered 106,910 BTC stolen from the crypto alternate after a multi-year investigation. The funds have been linked to Ilya Lichtenstein and Heather Morgan, who laundered billions earlier than being arrested in 2022.

Silk Highway (2013) — The federal government confiscated 81,988 BTC from the darkish net market operated by Ross Ulbricht. This stays one of many earliest and most well-known crypto seizures.

Potapenko/Turogin (2022) — A smaller seizure of 667 BTC linked to Estonian nationals accused of operating a $575 million crypto fraud by way of shell mining providers.

Collectively, these seizures spotlight how the US has quietly change into a serious Bitcoin whale—a place gained not by way of funding, however by way of relentless enforcement and asset restoration within the digital age.

Bitcoin Holds Assist However Faces Resistance Forward

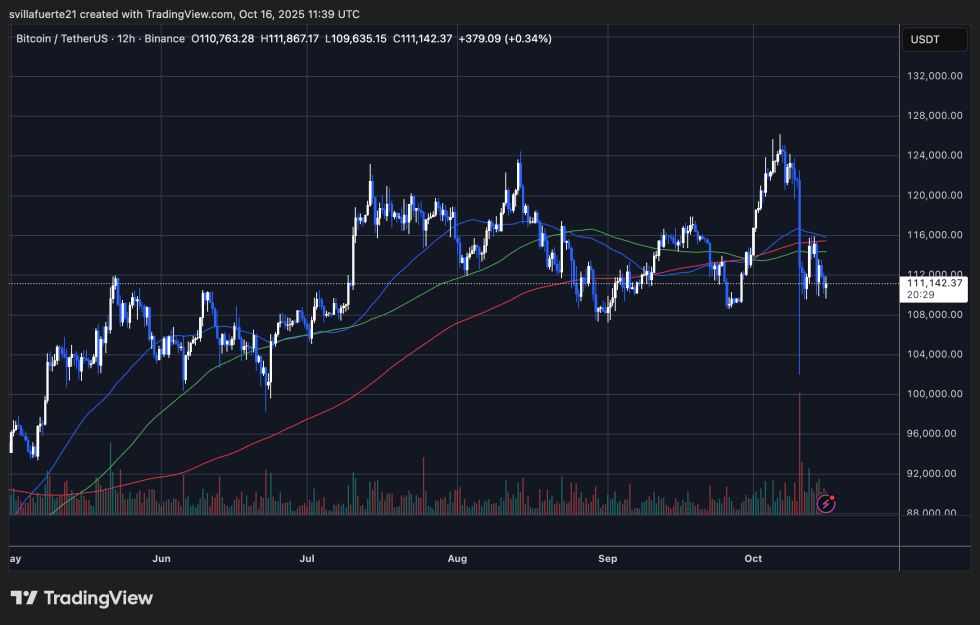

Bitcoin (BTC) is buying and selling round $111,142, exhibiting indicators of stabilization after final week’s flash crash that briefly despatched costs under $104,000. The 12-hour chart reveals that BTC has discovered short-term assist close to the $110,000 zone, which has acted as a key demand space a number of occasions since mid-September. This vary now serves as a battleground between cautious patrons and sellers capitalizing on market weak spot.

Nevertheless, BTC stays under the 50-day (blue) and 100-day (inexperienced) shifting averages, each at present converging round $114,000–$116,000, creating sturdy short-term resistance. The 200-day (pink) shifting common sits close to $112,000, barely above present ranges, signaling that the broader pattern remains to be fragile. A clear break above these ranges may open the trail towards $117,500, however failure to regain momentum could expose BTC to a different take a look at of $108,000–$110,000.

Buying and selling volumes stay elevated however barely cooling in comparison with final Friday’s capitulation occasion, suggesting consolidation slightly than panic. Total, Bitcoin seems to be in a restoration section, although the shortage of directional conviction signifies that merchants are ready for stronger catalysts — whether or not from macro information, ETF flows, or on-chain alerts — earlier than taking decisive positions.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.