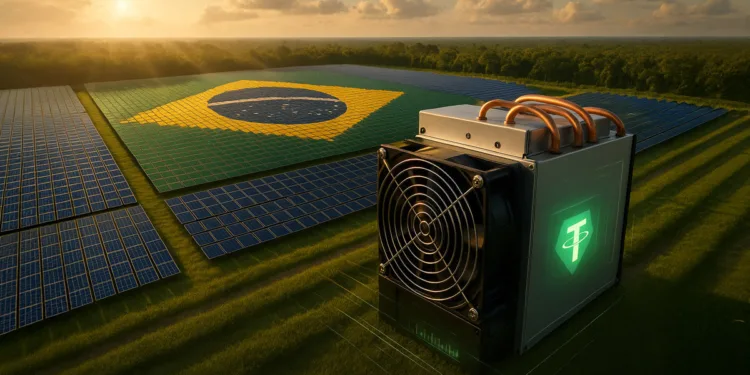

Stablecoin issuer Tether has signed a Memorandum of Understanding (MoU) with Adecoagro S.A. to discover a strategic collaboration centered on renewable-powered Bitcoin mining, based on a July 3 assertion.

Adecoagro, one among South America’s main producers of sustainable agricultural items and power, is evaluating how its greater than 230 MW of renewable power capability can be utilized to help energy-intensive industries like Bitcoin mining.

Mariano Bosch, the Chief Govt Officer of Adecoagro, stated:

“This undertaking opens the door to stabilizing a portion of the power we at present promote on the spot market, locking in pricing, whereas additionally gaining publicity to the upside potential of bitcoin.”

The collaboration will concentrate on optimizing surplus power technology whereas creating new fashions for digital infrastructure tied to scrub power sources.

Adecoagro additionally views this initiative as a approach to introduce Bitcoin publicity to its company steadiness sheet step by step, treating it as a possible retailer of worth just like its farmland property.

The pilot mining undertaking will function on Tether’s proprietary Mining OS, a website administration platform anticipated to be open-sourced within the coming months.

Tether CEO Paolo Ardoino stated the initiative displays the agency’s dedication to selling accountable Bitcoin mining.

He added:

“This undertaking is one other step in our rising dedication to renewable-powered bitcoin mining and highlights the potential to align agricultural power manufacturing with cutting-edge digital infrastructure. We imagine this mannequin can drive monetary inclusion, promote power effectivity, and function a blueprint for accountable innovation on the intersection of expertise and sustainability.”

In the meantime, this MoU builds on the latest transaction settlement between the 2 companies, which can see Tether purchase roughly 70% of Adecoagro’s excellent shares.

The deal alerts a deeper strategic alignment as each companies discover methods to merge conventional infrastructure with blockchain-based applied sciences.

The transfer comes amid Tether’s broader effort to diversify its enterprise past USDT, the world’s largest stablecoin with a market capitalization exceeding $158 billion.

The corporate has not too long ago ventured into synthetic intelligence, crypto training, and scalable mining infrastructure as a part of its increasing digital technique.