Key Takeaways

- Michael Saylor will current a Bitcoin funding technique to Microsoft’s board.

- The board beforehand argued that Microsoft already evaluates numerous belongings, together with Bitcoin, and that their present focus is on stability and minimizing danger.

Share this text

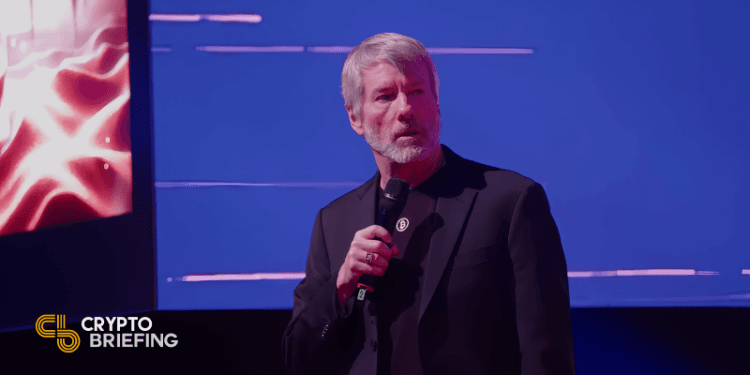

Michael Saylor will share his insights on Bitcoin funding methods in a three-minute presentation to Microsoft’s board of administrators, following a proposal from the Nationwide Heart for Public Coverage Analysis (NCPPR)—who urged Microsoft to contemplate Bitcoin funding.

“The activist that put that proposal collectively contacted me to current to the board, and I agreed to supply a three-minute presentation,” stated MicroStrategy co-founder and Government Chairman throughout a X Areas occasion hosted by VanEck. “I’m going to current it to the board of administrators.”

Saylor has publicly inspired Microsoft to contemplate including Bitcoin to its treasury. He believes it will possibly make “the following trillion {dollars}” for Microsoft shareholders.

Firms like Berkshire Hathaway, Apple, Google, and Meta (previously Fb) ought to focus on and consider Bitcoin as a possible funding, Saylor advised, “as a result of all of them have enormous hordes of money, they usually’re all burning shareholder worth.”

Microsoft shareholders are scheduled to vote on a proposal to contemplate including Bitcoin to its stability sheet on December 10. Prime shareholders embrace main monetary establishments like Vanguard Group, BlackRock, State Road, and Constancy Administration & Analysis.

Vanguard, a recognized crypto skeptic, has additionally invested in MicroStrategy’s inventory (MSTR), in addition to shares of different crypto corporations like Coinbase and MARA Holdings. As of September 30, the asset administration large reported holding roughly 16 million MSTR shares.

MicroStrategy’s Bitcoin technique has led to very large inventory value appreciation, outperforming Microsoft’s inventory (MSFT) efficiency.

In accordance with knowledge from Yahoo Finance, MicroStrategy’s inventory jumped to a contemporary report excessive at market shut on Tuesday. It has skyrocketed 581% to date this yr, whereas Microsoft’s inventory has seen round 12% features over the identical timeframe.

The NCPPR beforehand used MicroStrategy’s Bitcoin technique to steer Microsoft management about Bitcoin shopping for ways. They famous that the corporate’s share value had outperformed Microsoft’s.

Microsoft’s board initially really helpful voting towards the proposal, stating they already “consider a variety of investable belongings,” together with Bitcoin. Whereas there may be curiosity from sure shareholders, Microsoft’s prime precedence is synthetic intelligence.

Nonetheless, Ethan Peck, deputy director of the NCPPR’s Free Enterprise Venture, warned that the evaluation may set off a shareholder lawsuit in the event that they determine to not spend money on Bitcoin and the asset’s worth subsequently rises.

Share this text