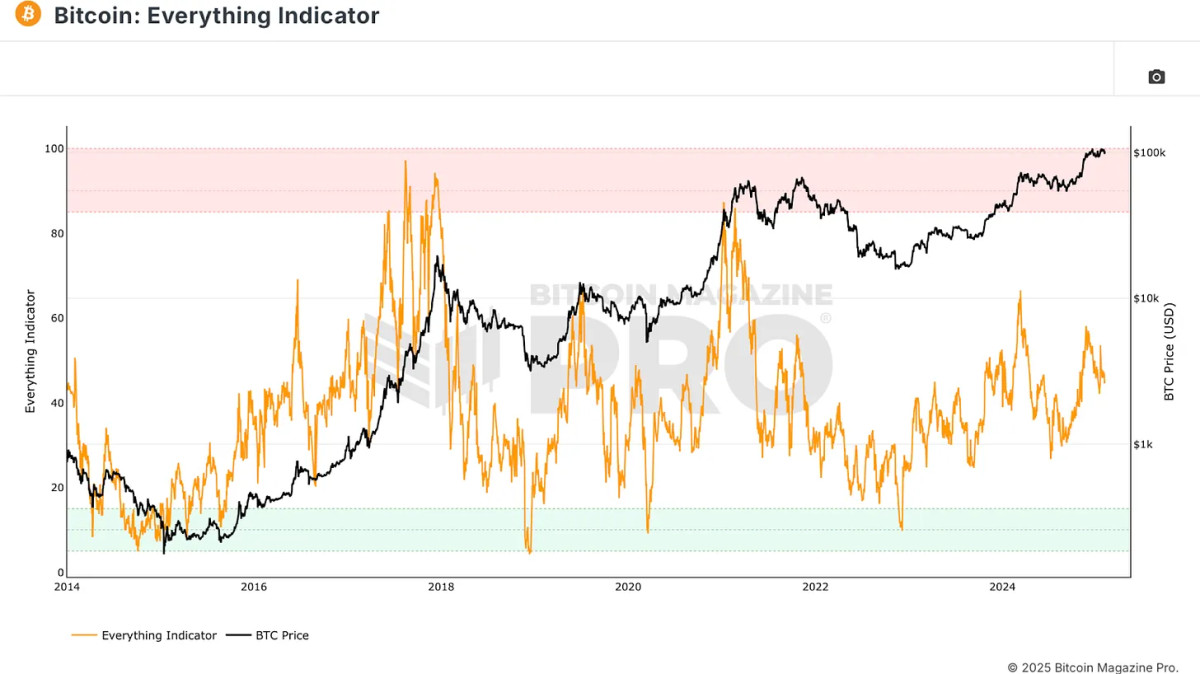

Wouldn’t it’s nice if we had one all-encompassing metric to information our Bitcoin investing choices? That’s exactly what has been created, the Bitcoin All the things Indicator. Just lately added to Bitcoin Journal Professional, this indicator goals to consolidate a number of metrics right into a single framework, making Bitcoin evaluation and funding decision-making extra streamlined.

For a extra in-depth look into this matter, take a look at a current YouTube video right here: The Official Bitcoin EVERYTHING Indicator

Why We Want a Complete Indicator

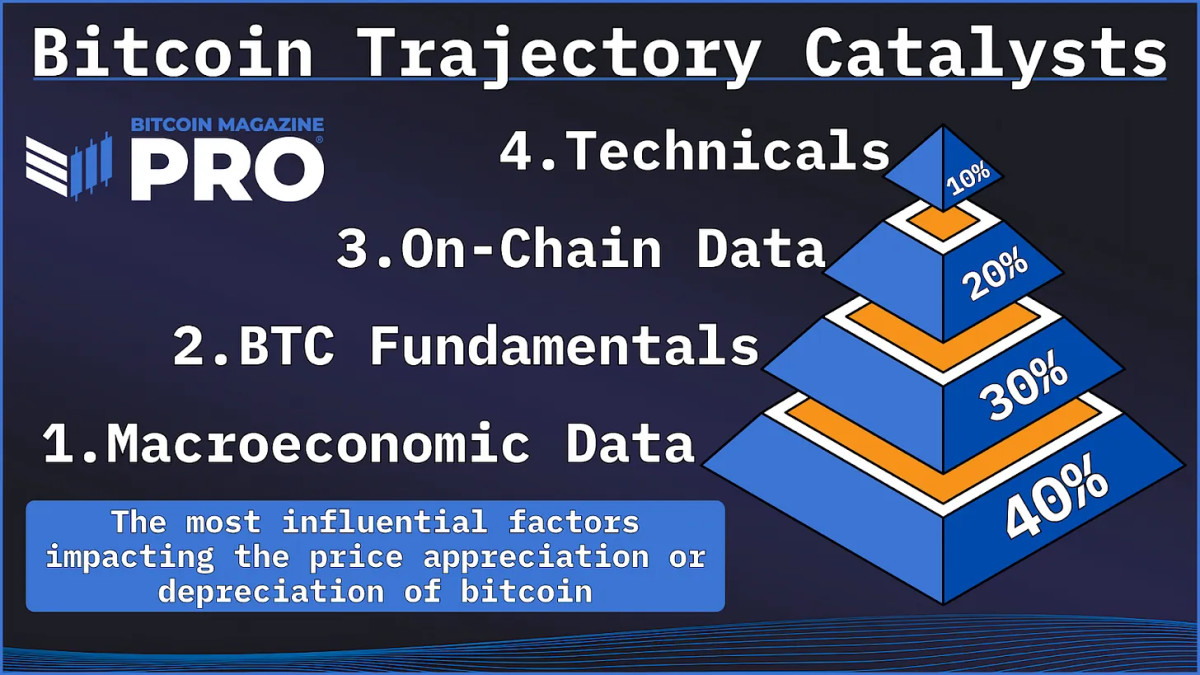

Buyers and analysts usually depend on numerous metrics, reminiscent of on-chain information, technical evaluation, and spinoff charts. Nonetheless, focusing an excessive amount of on one side can result in an incomplete understanding of Bitcoin’s value actions. The Bitcoin All the things Indicator makes an attempt to resolve this by integrating key elements into one clear metric.

The Core Elements of the Bitcoin All the things Indicator

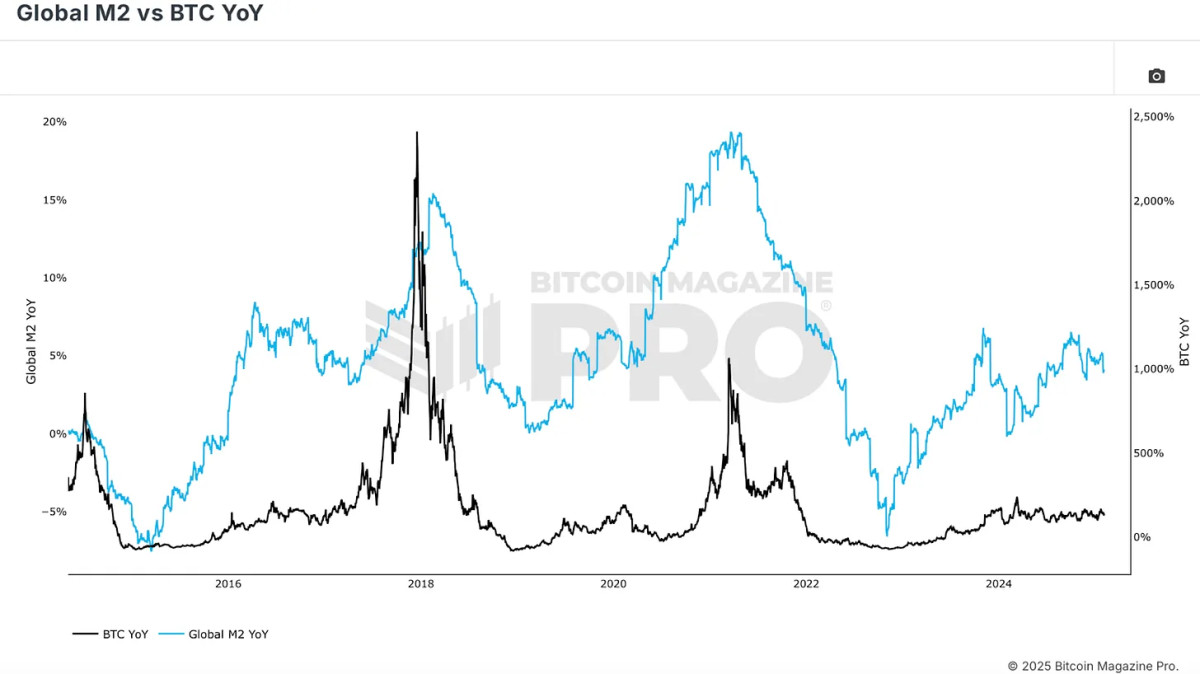

Bitcoin’s value motion is deeply influenced by international liquidity cycles, making macroeconomic circumstances a elementary pillar of this indicator. The correlation between Bitcoin and broader monetary markets, particularly by way of International M2 cash provide, is evident. When liquidity expands, Bitcoin usually appreciates.

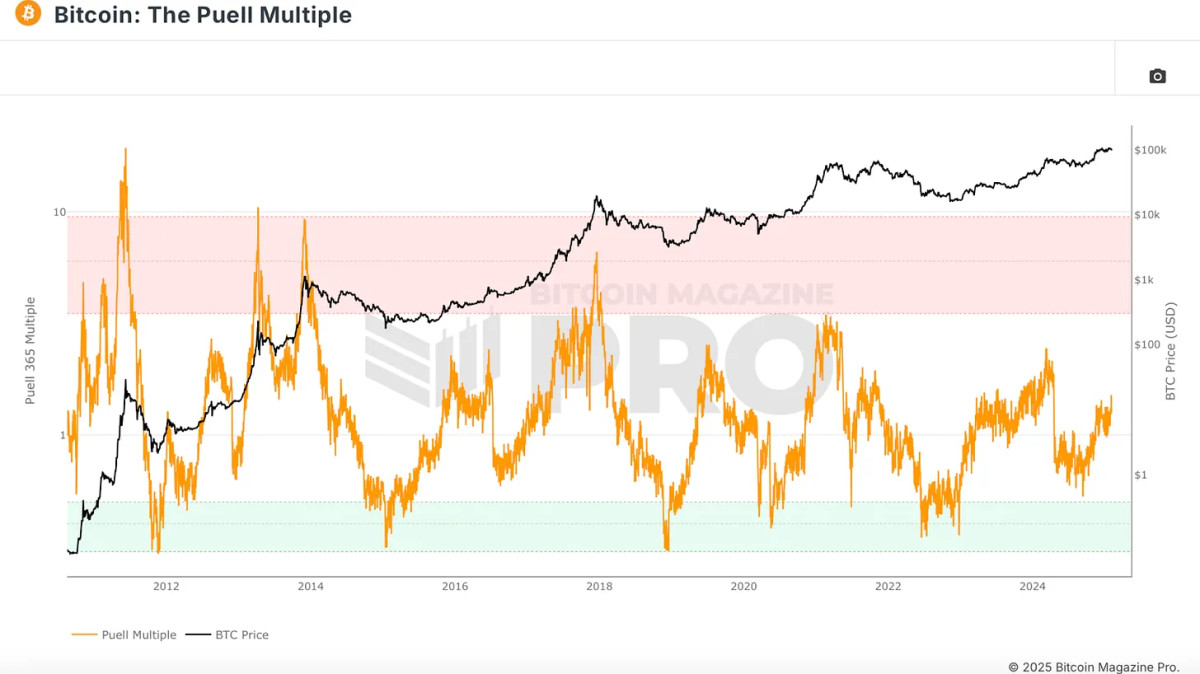

Elementary elements like Bitcoin’s halving cycles and miner energy play an important position in its valuation. Whereas halvings lower new Bitcoin provide, their affect on value appreciation has diminished as over 94% of Bitcoin’s whole provide is already in circulation. Nonetheless, miner profitability stays essential. The Puell A number of, which measures miner income relative to historic averages, offers insights into market cycles. Traditionally, when miner profitability is powerful, Bitcoin tends to be in a positive place.

On-chain indicators assist assess Bitcoin’s provide and demand dynamics. The MVRV Z-Rating, for instance, compares Bitcoin’s market cap to its realized cap (common buy value of all cash). This metric identifies accumulation and distribution zones, highlighting when Bitcoin is overvalued or undervalued.

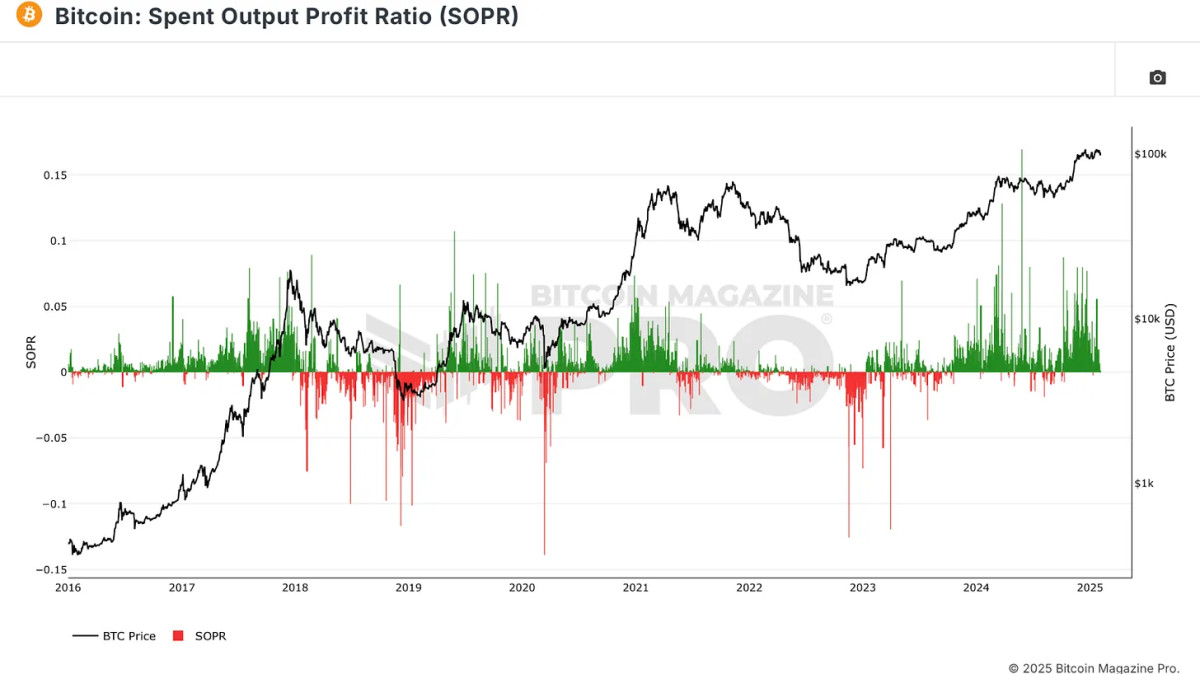

One other important on-chain metric is the Spent Output Revenue Ratio (SOPR), which examines the profitability of cash being spent. When Bitcoin holders understand huge income, it typically indicators a market peak, whereas excessive losses point out a market backside.

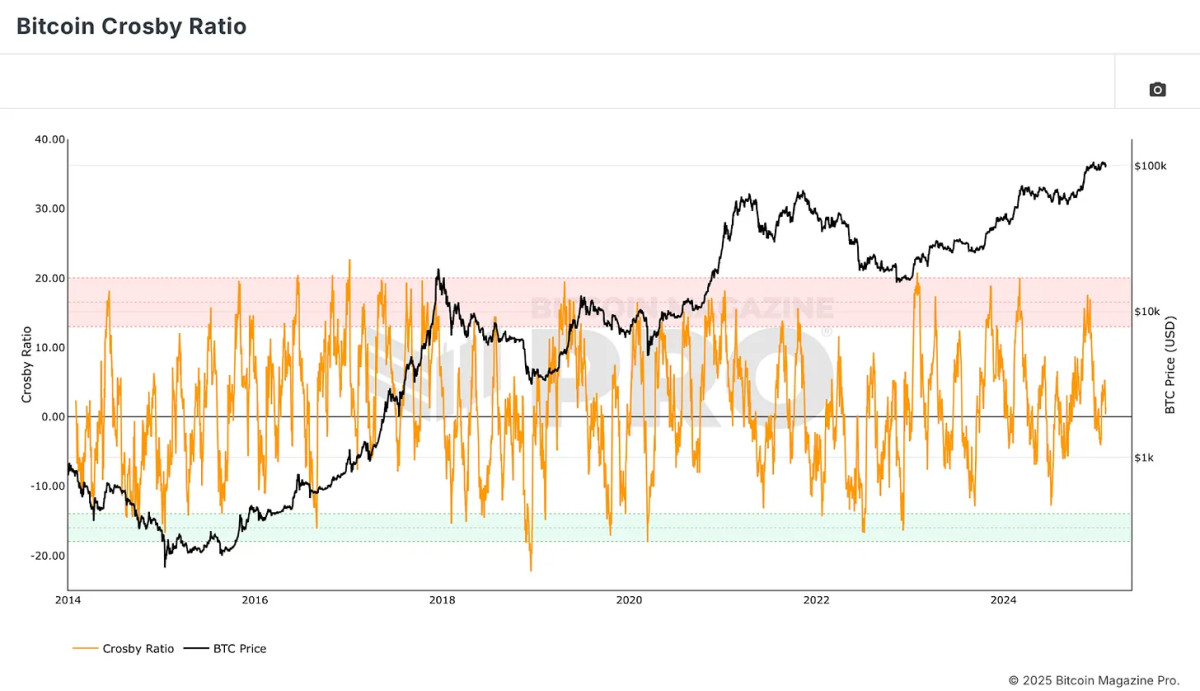

The Bitcoin Crosby Ratio is a technical metric that assesses Bitcoin’s overextended or discounted circumstances purely based mostly on value motion. This ensures that market sentiment and momentum are additionally accounted for within the Bitcoin All the things Indicator.

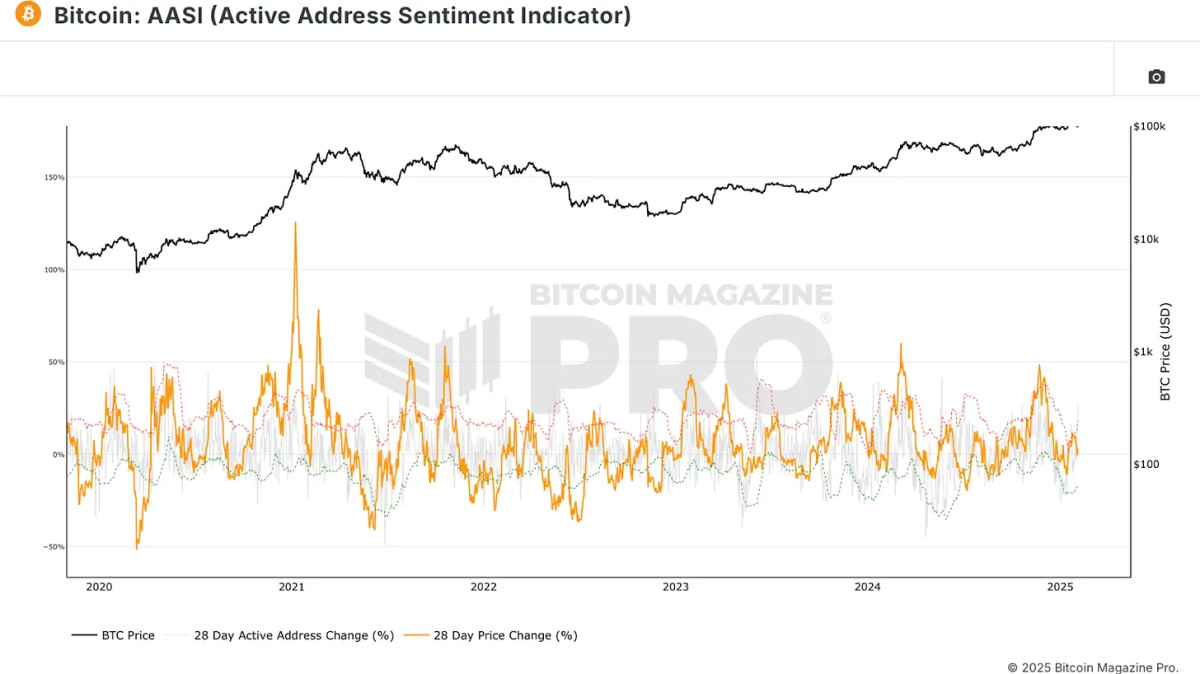

Community utilization can supply important clues about Bitcoin’s energy. The Lively Tackle Sentiment Indicator measures the share change in energetic addresses over 28 days. An increase in energetic addresses typically confirms a bullish pattern, whereas stagnation or decline might sign value weak point.

How the Bitcoin All the things Indicator Works

By mixing these numerous metrics, the Bitcoin All the things Indicator ensures that no single issue is given undue weight. In contrast to fashions that rely too closely on particular indicators, such because the MVRV Z-Rating or the Pi Cycle Prime, this indicator distributes affect equally throughout a number of classes. This prevents overfitting and permits the mannequin to adapt to altering market circumstances.

Historic Efficiency vs. Purchase-and-Maintain Technique

Some of the putting findings is that the Bitcoin All the things Indicator has outperformed a easy buy-and-hold technique since Bitcoin was valued at beneath $6. Utilizing a method of accumulating Bitcoin throughout oversold circumstances and progressively promoting in overbought zones, buyers utilizing this mannequin would have considerably elevated their portfolio’s efficiency with decrease drawdowns.

For example, this mannequin maintains a 20% drawdown in comparison with the 60-90% declines usually seen in Bitcoin’s historical past. This implies {that a} well-balanced, data-driven strategy may help buyers make extra knowledgeable choices with decreased draw back danger.

Conclusion

The Bitcoin All the things Indicator simplifies investing by merging probably the most important points influencing Bitcoin’s value motion right into a single metric. It has traditionally outperformed buy-and-hold methods whereas mitigating danger, making it a beneficial software for each retail and institutional buyers.

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, personalised indicator alerts, and in-depth trade studies, take a look at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding choices.