Shopping for Bitcoin at considerably larger costs than just some months in the past might be daunting. Nevertheless, with the correct methods, you should buy Bitcoin throughout dips with a positive risk-to-reward ratio whereas driving the bull market.

Confirming Bull Market Situations

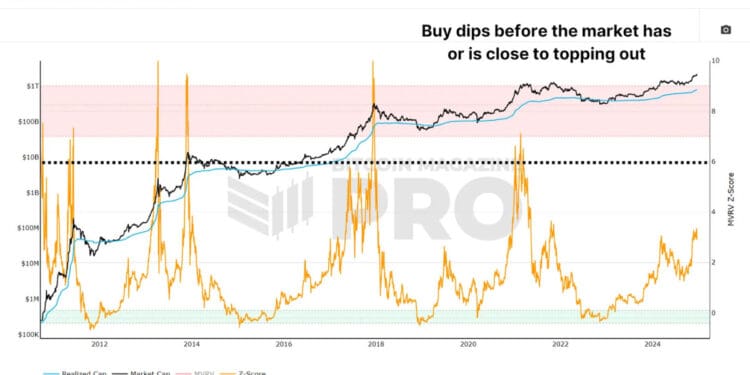

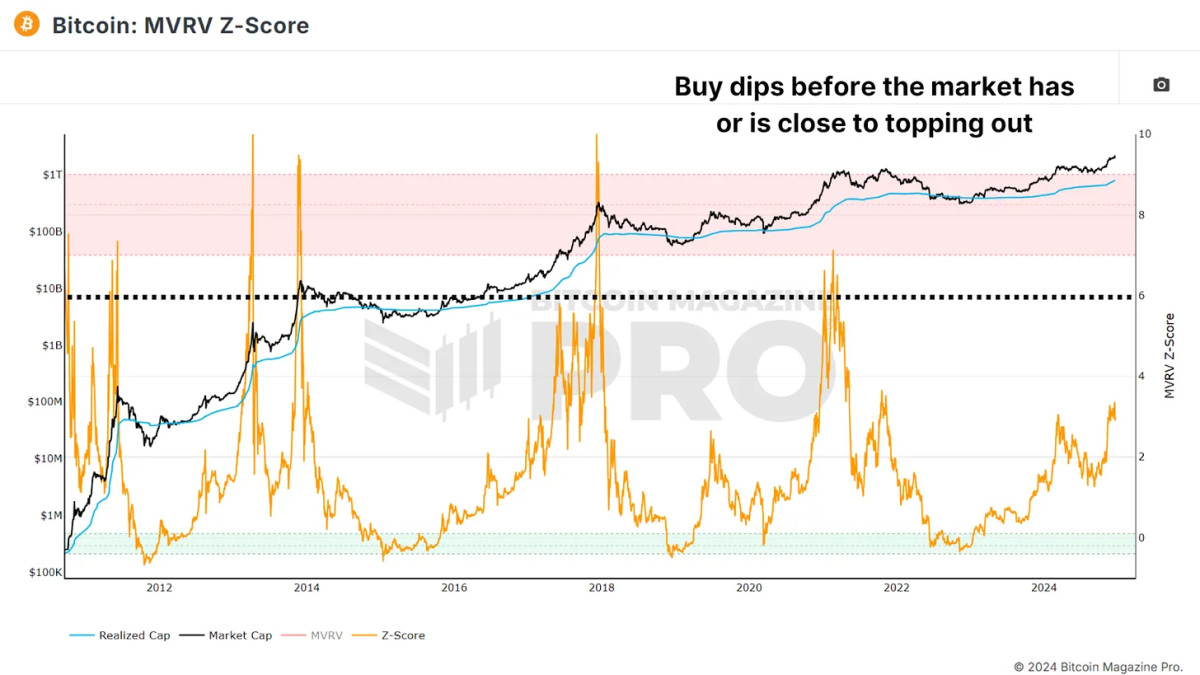

Earlier than accumulating, make sure you’re nonetheless in a bull market. The MVRV Z-score helps establish overheated or undervalued situations by analyzing the deviation between market worth and realized worth.

Keep away from Shopping for when the Z-score reaches excessive values, corresponding to above 6.00, which might point out the market is overextended and nearing a possible bearish reversal. If the Z-score is beneath this, dips probably signify alternatives, particularly if different indicators align. Don’t accumulate aggressively throughout a bear market. Focus as a substitute on discovering the macro backside.

Brief-Time period Holders

This chart displays the typical value foundation of latest market individuals, providing a glimpse into the Brief-Time period Holder exercise. Traditionally, throughout bull cycles, every time the worth rebounds off the Brief-Time period Holder Realized Worth line (or barely dips beneath), it has introduced wonderful alternatives for accumulation.

Gauging Market Sentiment

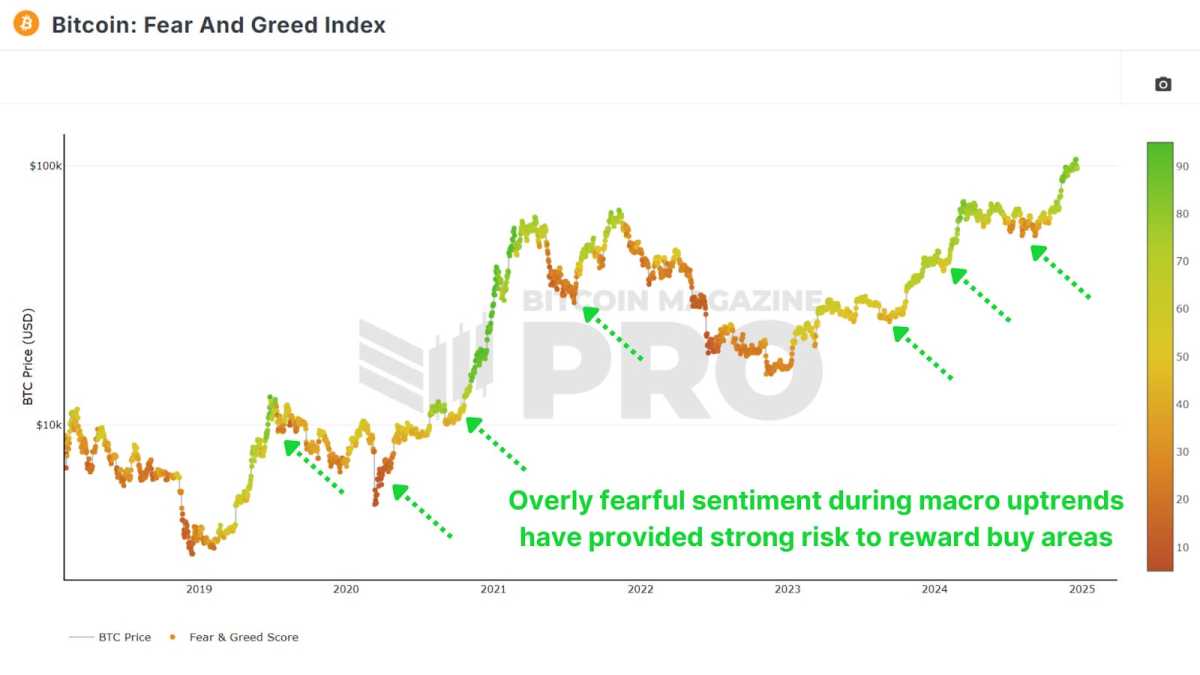

Although easy, the Concern and Greed Index gives priceless perception into market feelings. Scores of 25 or beneath typically signify excessive worry, which frequently accompanies irrational sell-offs. These moments supply favorable risk-to-reward situations.

Recognizing Market Overreaction

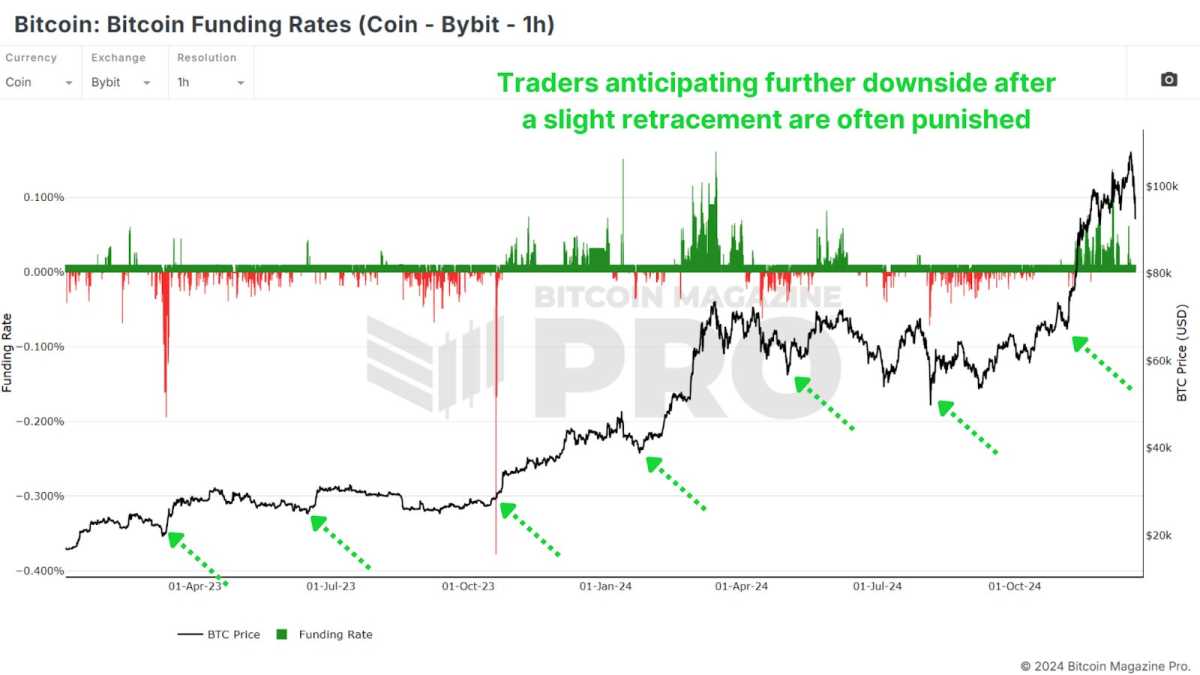

Funding Charges replicate dealer sentiment in futures markets. Adverse Funding throughout bull cycles are notably telling. Exchanges like Bybit, which magnetize retail traders, present that detrimental Charges are a robust sign for accumulation throughout dips.

When merchants use BTC as collateral, detrimental charges typically point out wonderful shopping for alternatives, as these shorting with Bitcoin are typically extra cautious and deliberate. That is why I choose specializing in Coin-Denominated Funding Charges versus common USD Charges.

Energetic Tackle Sentiment Indicator

This instrument measures the divergence between Bitcoin’s value and community exercise, after we see a divergence within the Energetic Tackle Sentiment Indicator (AASI) it signifies that there’s overly bearish value motion given how sturdy the underlying community utilization is.

My most well-liked technique of utilization is to attend till the 28-day share value change dips beneath the decrease commonplace deviation band of the 28-day share change in lively addresses and crosses again above. This purchase sign confirms community power and sometimes alerts a reversal.

Conclusion

Accumulating throughout bull market dips entails managing danger moderately than chasing bottoms. Shopping for barely larger however in oversold situations reduces the chance of experiencing a 20%-40% drawdown in comparison with buying throughout a pointy rally.

Affirm we’re nonetheless in a bull market and dips are for purchasing, then establish favorable shopping for zones utilizing a number of metrics for confluence, corresponding to Brief-Time period Holder Realized Worth, Concern & Greed Index, Funding Charges, and AASI. Prioritize small, incremental purchases (dollar-cost averaging) over going all-in and give attention to risk-to-reward ratios moderately than absolute greenback quantities.

By combining these methods, you can also make knowledgeable choices and capitalize on the distinctive alternatives introduced by bull market dips. For a extra in-depth look into this subject, take a look at a latest YouTube video right here: How To Accumulate Bitcoin Bull Market Dips

For extra detailed Bitcoin evaluation and to entry superior options like dwell charts, customized indicator alerts, and in-depth trade studies, take a look at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.