Everybody stated Ethereum worth was locked in on $10,000 this bull run, however now prime analysts from a number one mining agency say not till 2030.

Ethereum is now seen as a turnaround story, a setup some analysts suppose might work to its profit.

Ethereum is presently present process a distinct part: a sluggish restoration following a protracted interval of weak sentiment. Matt Hougan, chief funding officer at Bitwise, says this rebuilding interval may give traders a helpful entry level.

To grasp this view, it helps to look at what has dragged the community down and what could also be bettering.

Is Ethereum Nonetheless Overpriced or Are Critics Lacking the Greater Image?

A crypto analyst means that Ethereum could also be due for a pointy re-rating over the subsequent yr.

He expects the asset to “meet up with the M2 cash provide” by the fourth quarter, which he believes helps a good worth between $8,000 and $10,000 by early 2026.

$ETH will meet up with the M2 provide in This autumn.

The truthful worth of Ethereum is $8,000-$10,000 by Q1 2026.

With institutional bidding and staking approval, I feel ETH will rally arduous. pic.twitter.com/GWhdqetubr

— Ted (@TedPillows) October 13, 2025

He additionally factors to rising curiosity from giant traders. In his view, constant shopping for and the prospect of latest staking approvals might assist push costs increased.

The message is straightforward: if demand builds and coverage stays supportive, ETH could have room to run.

Earlier this yr, even long-time supporters nervous the ecosystem had misplaced power as a sequence of setbacks piled up.

On-chain exercise slowed, and critics argued that the push to scale via layer-2 networks had backfired.

There as soon as was a cow named "$ETH" who was being milked dry by its 'caretakers'. When bystanders stated "hey that's not good for $ETH", the 'caretakers' bought actually upset on the bystanders, fully ignoring the irony that they had been those killing the cow for private enrichment. pic.twitter.com/WBMtspGqqh

— Quinn Thompson (@qthomp) March 30, 2025

They stated the strategy weakened token economics and shifted worth away from the principle chain. Some even claimed Ethereum was now overpriced and now not interesting to traders.

Hougan, nevertheless, notes that Ethereum nonetheless holds a core benefit that many overlook: its central place throughout the stablecoin ecosystem.

“All funds will likely be on stablecoins,” he stated. At the moment, most stablecoins function on Ethereum.

USDT and USDC, which collectively account for greater than two-thirds of the worldwide stablecoin provide, are issued primarily on Ethereum.

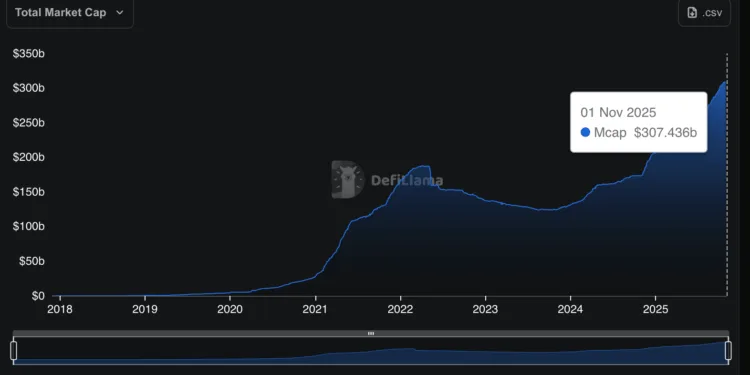

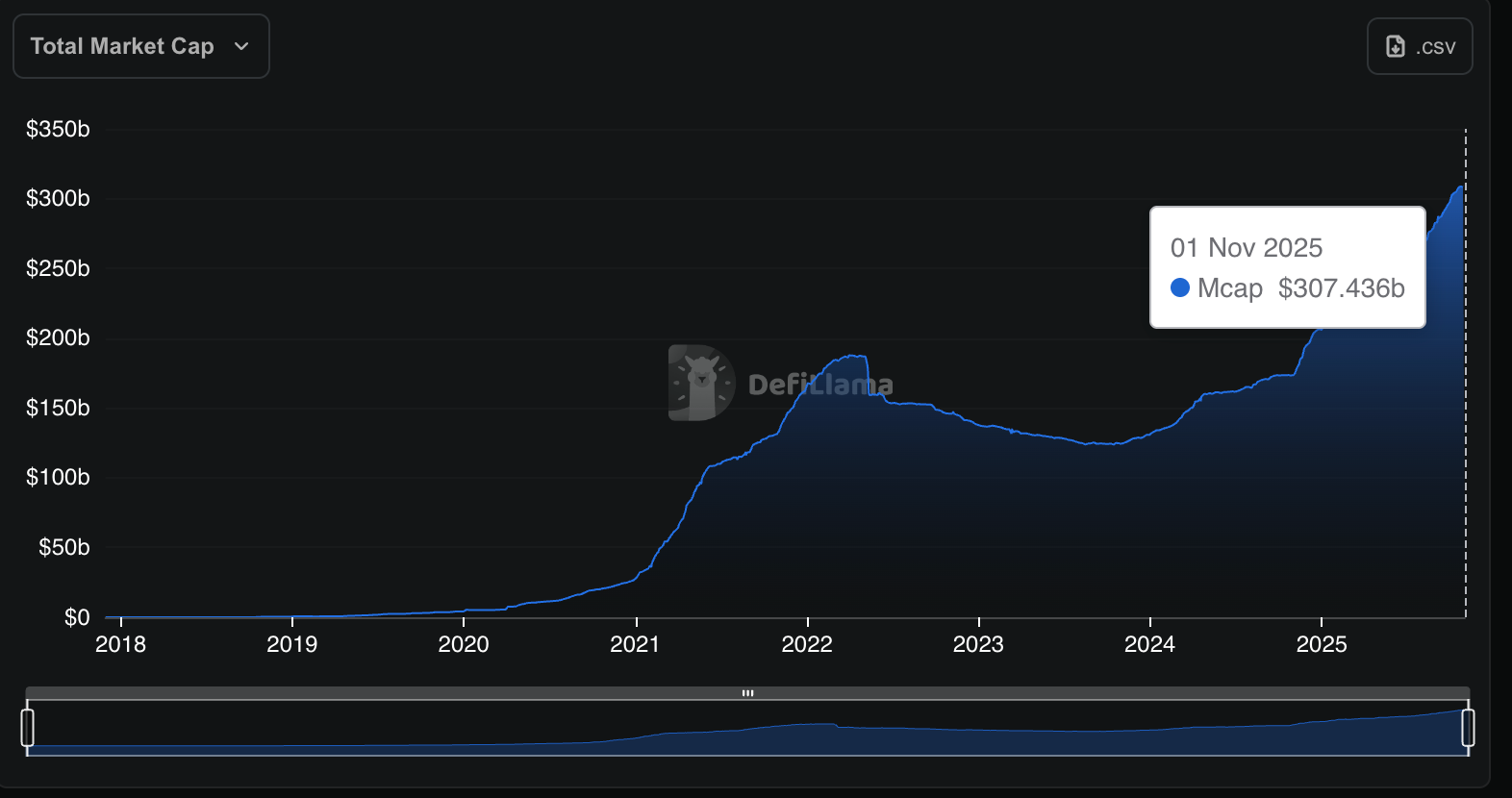

Knowledge from DefiLlama signifies that over 53% of the sector’s $307Bn market operates on Ethereum. Solana, by comparability, holds simply over 4%.

As banks and fee corporations undertake stablecoins for settlements, funds, and treasury work, Ethereum might stay the principle community supporting that exercise.

Massive establishments are already transferring in. JPMorgan, for instance, has began accepting crypto as collateral.

JPMorgan to permit its institutional shoppers to make use of bitcoin and ether as collateral for loans as crypto continues to get absorbed into Wall Avenue's plumbing. Good scoop from @emilyjnicolle and one more instance of Life Strikes Fairly Quick pic.twitter.com/ej68sOHm9J

— Eric Balchunas (@EricBalchunas) October 24, 2025

Ripple plans to place $1Bn into increasing stablecoin use in company treasuries. On the identical time, BlackRock’s tokenized treasury fund has reached about $2.5Bn.

Each strikes direct extra exercise towards Ethereum, which earns charges when stablecoins are transferred throughout the community.

Tom Lee, a widely known strategist who helps run one of many greatest Ethereum-focused treasury corporations, known as stablecoins the “ChatGPT of crypto” in a June 30 interview on CNBC, citing their quick adoption.

Ethereum Value Prediction: Will ETH Reclaim Market Share If The 12–13% Zone Holds?

In accordance with Mister Crypto, Ethereum’s share of the market could also be near a bounce.

The chart exhibits ETH dominance sliding towards an upward trendline that has held since April 2025.

Every time the worth touched this line up to now, marked by inexperienced arrows, the market noticed a recent transfer increased.

The newest candle is sitting simply above that trendline, suggesting patrons are nonetheless defending the 12–13% space.

That assist has acted as a ground earlier than, and merchants are watching to see if it does the identical once more.

Value motion nonetheless factors to an uptrend, though issues have cooled.

Ethereum dominance pulled again from above 16% in late summer time however continues to kind increased lows, which suggests the general construction is holding.

The stochastic oscillator has slipped into oversold territory for the primary time since early 2025. That setup appears to be like just like moments that got here earlier than robust rebounds.

If this assist stage holds, Ethereum could begin to achieve market share once more as merchants shift towards main altcoins. But when the trendline breaks, it will sign fading power and will push any restoration additional out.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

The submit Ethereum Value To $10,000? Analysts Say Not This Cycle appeared first on 99Bitcoins.