Grayscale Investments will checklist spot ETFs for Dogecoin and XRP on the NYSE Arca on November 24, 2025, providing a brand new means for on a regular basis buyers to purchase these cash by common brokerages.

Associated Studying

In accordance with change notices and regulatory filings, the funds will commerce underneath the tickers GDOG for Dogecoin and GXRP for XRP. The listings convert Grayscale’s current private-placement trusts into publicly traded merchandise.

Grayscale Strikes To Checklist Dogecoin And XRP

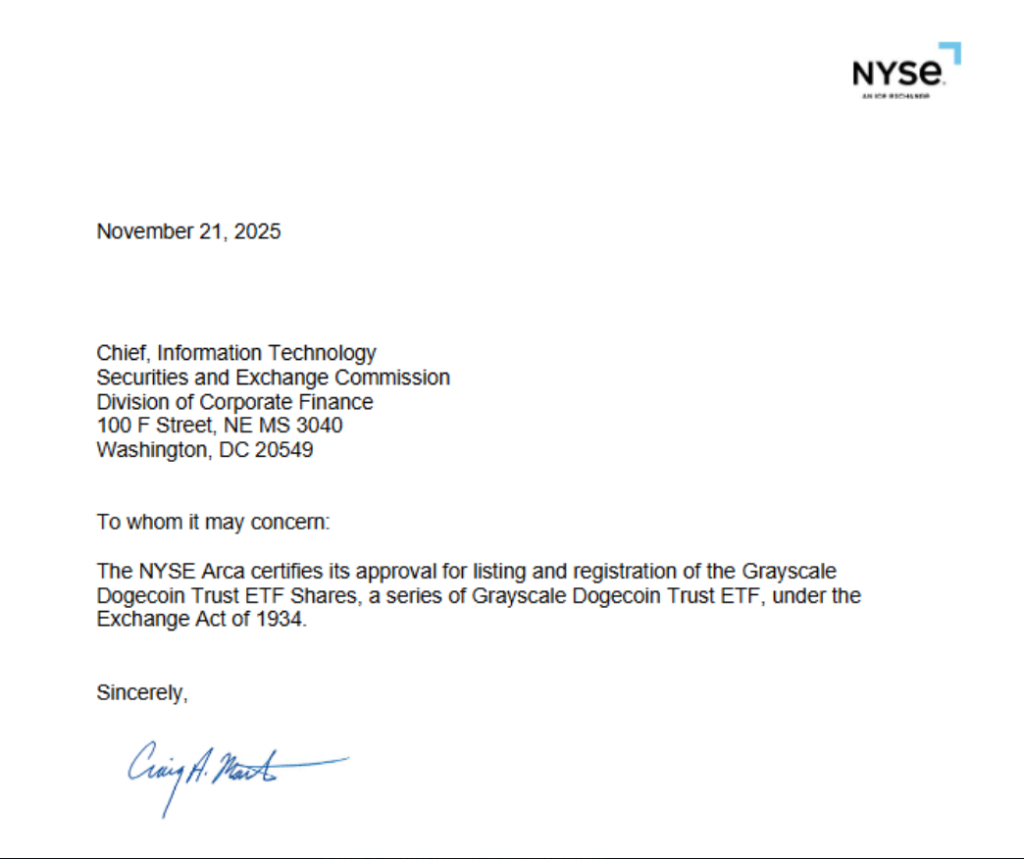

Experiences have disclosed that each ETFs obtained approval to be listed, and the paperwork was filed with the US Securities and Trade Fee.

The transfer brings spot publicity to 2 smaller, however broadly adopted, cryptocurrencies right into a mainstream automobile. For a lot of buyers, which means entry with out straight managing wallets or non-public keys.

Grayscale Dogecoin ETF $GDOG authorized for itemizing on NYSE, scheduled to start buying and selling Monday. Their XRP spot can also be launching on Monday. $GLNK coming quickly as nicely, week after I believe pic.twitter.com/c6nKUeDrtI

— Eric Balchunas (@EricBalchunas) November 21, 2025

Market Exercise Up Forward Of Launch

Buying and selling exercise in associated derivatives climbed within the lead as much as the announcement. Dogecoin derivatives quantity elevated by greater than 30% to roughly $7.22 billion, based mostly on change information.

XRP derivatives surged as nicely, leaping about 51% to round $12.74 billion. Primarily based on reviews, these spikes mirror merchants positioning for potential worth swings across the ETF debut.

Spot ETFs don’t promise greater costs, however they do change who can purchase the belongings. Brokers, retirement plans, and funds that keep away from direct crypto custody might now step in.

That would have an effect on liquidity in each the tokens and their markets. On the similar time, the general crypto market has seen stress; reviews say the launches come throughout a roughly six-week downturn.

DOGE market cap at present at $21.4 billion. Chart: TradingView

Questions Stay Over Demand And Flows

Product charges, custody particulars, and the way the trusts convert into ETF shares will form investor urge for food. Previous launches of crypto ETFs confirmed brisk early flows for some merchandise, whereas others noticed muted curiosity. What issues for costs shouldn’t be solely listings, however inflows and outflows as soon as buying and selling begins.

Associated Studying

Buyers and analysts are prone to watch the primary days of buying and selling for clues. Excessive quantity and tight spreads would recommend robust demand. Low turnover or huge spreads might sign tepid curiosity.

Primarily based on reviews, market members will even monitor whether or not the ETFs draw the identical type of speculative buying and selling that has pushed derivatives quantity in current days.

The itemizing of each GDOG and GXRP on the identical date marks a notable step for mainstream crypto merchandise. In accordance with change filings, the funds are structured as spot ETFs that maintain the underlying tokens through custodians. Whereas that doesn’t take away worth threat, it does make shopping for these belongings easier for a broad group of buyers.

Featured picture from Gemini, chart from TradingView