Key Takeaways

- Trump’s tariff push on the EU and difficult discuss on Apple instantly despatched Bitcoin beneath $108,000 in early Friday buying and selling.

- Apple should construct iPhones within the US or face a 25% tariff, Trump warned.

Share this text

The value of Bitcoin (BTC) fell beneath $108,000 early Friday after President Donald Trump referred to as for steep tariffs on EU imports and threatened Apple with comparable measures. The digital asset briefly touched $107,300 on Binance, pulling again from session highs above $111,000 as merchants responded to contemporary geopolitical tensions.

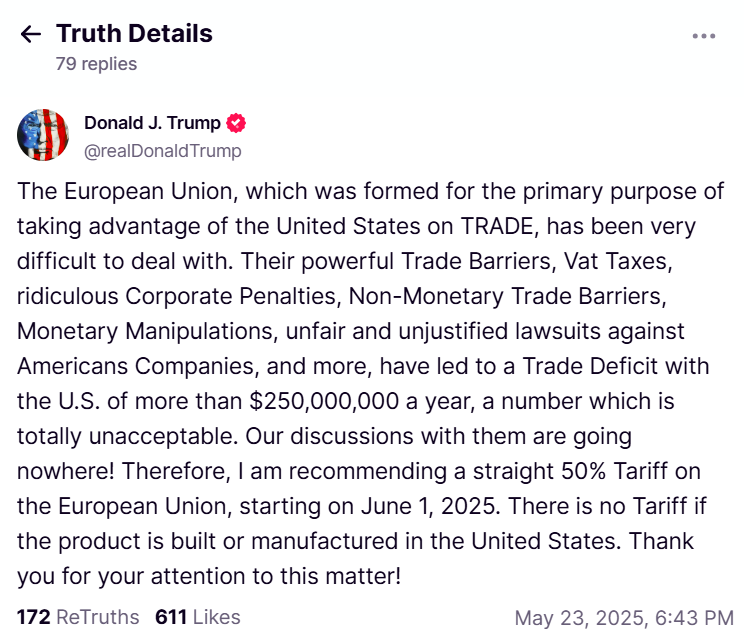

The US president on Friday proposed a 50% tariff on all EU imports beginning June 1, 2025, in a publish on Reality Social. He cited commerce imbalances and regulatory frictions as rationale for the transfer, declaring present EU-US commerce dynamics “completely unacceptable.”

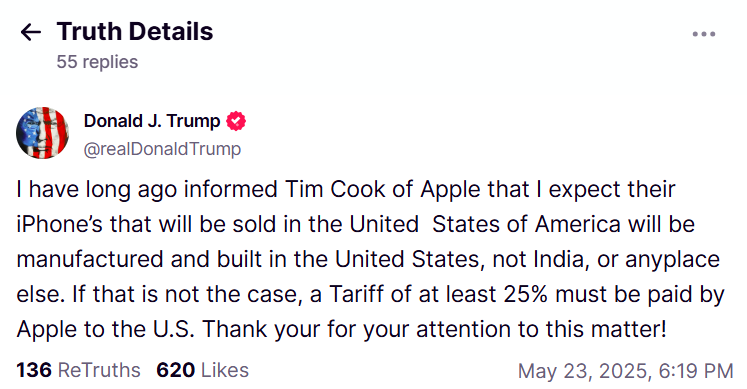

Trump additionally issued a direct warning to Apple this morning, stating that iPhones bought in America should be constructed domestically or face a 25% tariff. The ultimatum to Apple CEO Tim Prepare dinner appeared aimed on the tech large’s intensive abroad manufacturing footprint.

Bitcoin’s pullback got here lower than 24 hours after it hit a brand new all-time excessive of $111,980, surpassing the earlier document of $109,588 set in January. The digital asset was buying and selling at round $108,200 at press time, down 2.5% prior to now 24 hours.

Demand for Bitcoin has been pushed by its rising correlation with gold, perceived safe-haven property, and heightened considerations about Japan’s and the US’s fiscal well being.

Moreover, elevated company and institutional help, together with acquisitions by entities like Technique and MARA Holdings, alongside strong investments in US-listed spot Bitcoin ETFs, additional bolsters Bitcoin’s market place.

Bitcoin’s current decline has mirrored cautious market sentiment. The crypto market’s response means that digital property stay delicate to macroeconomic and political developments.

Share this text