Bitcoin noticed a modest retracement yesterday, dipping barely however persevering with to commerce inside a decent vary between key assist and resistance ranges. Whereas the broader altcoin market faces heightened volatility and notable losses, BTC stays comparatively resilient, but momentum seems unsure. Analysts warn that if sentiment weakens, a broader correction may unfold.

Associated Studying

High analyst Darkfost highlighted a important dynamic now unfolding: the vulnerability of Quick-Time period Holders (STH). These traders, who entered the market throughout current worth surges, maintain Bitcoin at considerably greater value bases. As worth motion stalls or retraces, they’re usually the primary to capitulate, creating elevated promoting strain.

With altcoins already underneath stress, all eyes stay on whether or not Bitcoin can maintain above present assist ranges or if it, too, will begin to crack underneath short-term selloffs. This section may act as a stress check for current consumers, whereas long-term holders and institutional individuals proceed to observe key worth zones.

Key Realized Worth Ranges Recommend Bitcoin Construction Stays Bullish

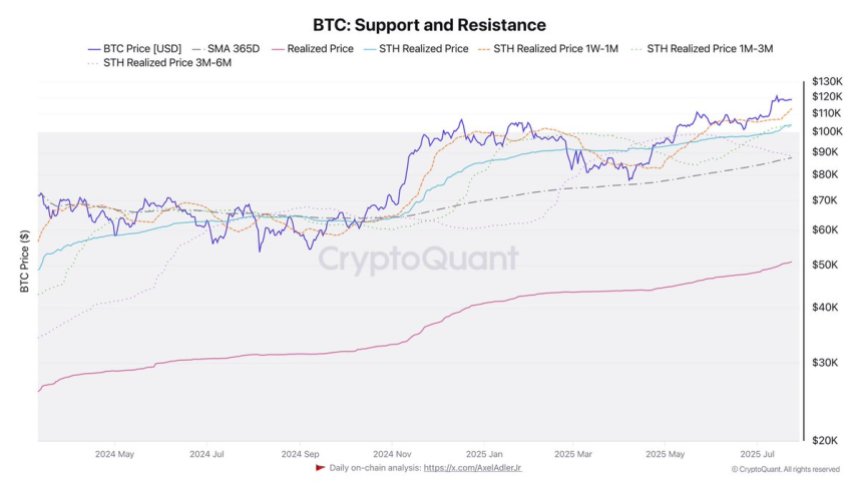

Darkfost has shared a chart providing a deep dive into Bitcoin’s realized costs throughout varied holding cohorts, notably specializing in Quick-Time period Holders (STHs). These metrics are proving essential in figuring out assist zones that may very well be defended if the value continues to right within the brief time period.

The broader realized worth for Bitcoin at the moment stands at $50.8K, whereas the annual common is considerably greater at $87.5K. Extra critically, the realized worth for STHs—those that bought cash not too long ago—is positioned at $103.9K. Breaking this down additional, we see realized costs by time held:

- STH 3m–6m: $88.2K

- STH 1m–3m: $104.1K

- STH 1w–1m: $113K

These figures signify the common worth at which completely different teams of current traders acquired their cash. As such, they function psychological and technical assist ranges throughout corrections.

With Bitcoin at the moment consolidating after a small retracement, bulls are eyeing these realized worth zones to gauge whether or not the construction stays bullish. The $104K stage, particularly, is crucial—it aligns intently with the 1m–3m STH realized worth and will function a decisive line for sentiment and worth protection.

If consumers can maintain BTC above this stage, the market’s bullish construction will seemingly stay intact, suggesting wholesome consolidation quite than development reversal. Conversely, dropping it may set off short-term panic promoting amongst current entrants.

Associated Studying

Bitcoin Worth Evaluation: Key Ranges Maintain After New Highs

Bitcoin continues to consolidate in a decent vary after setting recent all-time highs earlier this month. As seen within the 3-day chart, BTC is holding above $115,724—a key horizontal assist—and beneath fast resistance close to $122,077. This consolidation vary has remained intact for over per week, reflecting each robust demand and hesitation close to psychological resistance.

Regardless of the current small pullback, the general market construction stays bullish. Worth is buying and selling nicely above the 50-day ($98,536), 100-day ($93,833), and 200-day ($76,201) easy shifting averages, which proceed to slope upward. This confirms robust medium- and long-term momentum.

Associated Studying

Quantity has declined barely throughout the present range-bound motion, indicating a pause after the aggressive rally from beneath $100,000. Nonetheless, bulls are clearly defending the $115,000–$116,000 area, a zone that coincides with the highest of the earlier breakout.

Featured picture from Dall-E, chart from TradingView