Bitcoin (BTC) is trying to reclaim the $110,000 degree after a pointy draw back transfer pressured markets and triggered renewed volatility throughout the crypto panorama. Whereas this pullback has been uncomfortable for short-term merchants, it stays modest in comparison with the October 10 liquidation crash, which compelled out extreme leverage and marked probably the most aggressive sell-offs of the yr.

Regardless of the short-term turbulence, Bitcoin stays inside its broader consolidation vary — however the market now enters a crucial section the place route should quickly resolve. Over the approaching weeks, macro developments, liquidity flows, and investor positioning will probably decide whether or not the subsequent impulse is upward or downward.

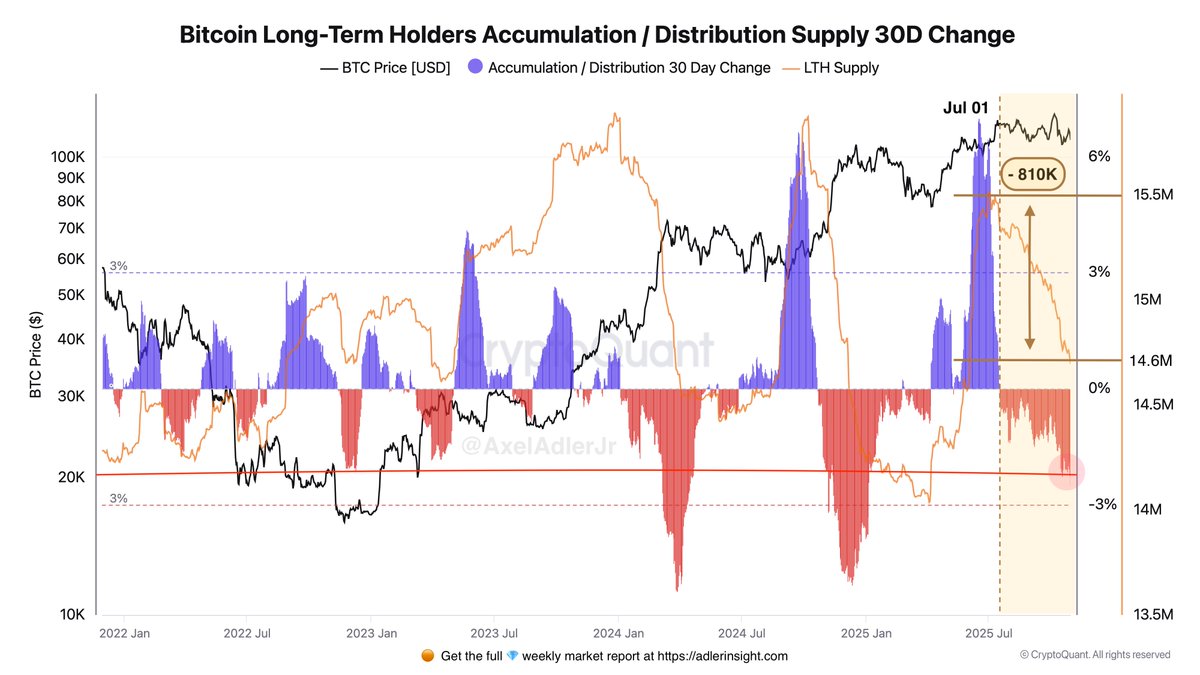

Recent CryptoQuant knowledge reveals that since July 1, long-term holders (LTHs) have been steadily distributing cash, promoting into power as BTC approached and later examined all-time highs. This provide overhang has contributed to muted upside momentum, at the same time as demand has confirmed sturdy sufficient to soak up a lot of the promoting.

Bitcoin Market Nonetheless Absorbs Provide

In line with analyst Axel Adler, Bitcoin continues to navigate a posh supply-demand setting outlined by regular profit-taking from long-term holders (LTHs). Since July 1, LTHs have distributed roughly 810,000 BTC, lowering their complete holdings from 15.5 million to 14.6 million BTC.

This represents probably the most important distribution phases within the present cycle — a transparent indication that seasoned holders have been locking in earnings after years of accumulation and strategic positioning.

What makes this dynamic significantly putting is that Bitcoin has printed new all-time highs twice throughout this distribution section, demonstrating that market demand has remained sturdy sufficient to soak up the substantial provide being offloaded.

Traditionally, related phases of distribution from long-term holders typically accompany main cycle inflection factors, as capital shifts from early buyers to new individuals getting into the market.

Adler emphasizes that whereas this absorption displays market power, it additionally units a ceiling on aggressive upside momentum. So long as long-term holders proceed to appreciate earnings, the trail increased is more likely to stay gradual and uneven quite than explosively parabolic. Sturdy demand is supporting costs and stopping deeper corrections — however provide stress is concurrently stopping sustained breakout acceleration.

The takeaway is evident: Bitcoin isn’t missing demand; it’s working by provide as soon as long-term distribution slows — whether or not as a consequence of exhaustion or macro reinforcement — upside potential may broaden meaningfully. Till then, value motion might proceed to grind sideways with upside makes an attempt assembly resistance as provide transitions to new homeowners.

Bitcoin Holds Above Key MA

Bitcoin (BTC) is buying and selling round $109,900, trying to stabilize after a current draw back transfer pushed value again towards the 200-day shifting common (pink line) — a key long-term help degree that at the moment sits close to $108,000.

This area has turn out to be an vital protection line for bulls, structuring the decrease boundary of Bitcoin’s consolidation vary. Every time BTC has approached this zone over the previous month, consumers have stepped in, signaling continued demand regardless of short-term weak point.

Nonetheless, reclaiming momentum stays a problem. BTC continues to battle under the 50-day (blue) and 100-day (inexperienced) shifting averages, which have converged overhead and now act as layered resistance between $112,000 and $114,000.

A sustained break above this cluster is required to re-establish bullish momentum and arrange one other try towards the $117,500 resistance — the cycle’s key Level of Management and the extent that has repeatedly capped upside strikes since summer time.

If Bitcoin loses the $108,000 help, a deeper correction towards $105,000–$103,000 turns into probably, the place liquidity and former response ranges sit. For now, the technical image stays neutral-to-cautious: bulls are holding important help, however the burden stays on consumers to reclaim misplaced shifting averages and flip market construction again of their favor.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.