In a wide-ranging September interview with Bitcoin Journal, MicroStrategy government chairman Michael Saylor condensed 5 years of company experimentation right into a stark, nearly mechanical blueprint for what he calls Bitcoin’s “endgame”: accumulate an unprecedented stockpile of the asset as digital capital, then manufacture a brand new tier of credit score markets on prime of it.

“The endgame is we accumulate a trillion {dollars} value of BTC after which we develop that capital by issuing extra credit score,” Saylor mentioned. He forged the maneuver not as a speculative facet guess however as the subsequent logical section of company finance, with Bitcoin reconstituted as “digital power” and steadiness sheets reimagined as engines that spin yield from over-collateralized, Bitcoin-backed devices.

Saylor’s Bitcoin Endgame Plan

Saylor’s framing is intentionally elemental. He stitched BTC right into a centuries-long lineage of civilization-scale power breakthroughs—from fireplace and metal to petroleum and electrical energy—arguing that the asset’s financial properties are greatest understood as a option to transfer financial “power” throughout time and house at mild pace.

“Bitcoin is hope as a result of Bitcoin represents digital power,” he mentioned. “A option to convey power by time, by house… the subsequent paradigm shift.” To Saylor, the institutional misunderstanding of that shift is just not a bug however the core of the chance. “I’d say 95% of the choice makers within the finance world nonetheless don’t actually embrace or perceive the concept of digital power,” he argued, including that society’s digestion lag is typical of paradigm shifts: “Bitcoin is evolving quicker than society can digest it.”

On the coronary heart of the playbook is a straightforward balance-sheet id, scaled. Deal with Bitcoin because the financial base—“digital gold”—then securitize it as “digital credit score” in types acquainted to capital markets: converts, preferreds, money-market-like paper, longer-duration bonds. “If I create an organization that buys Bitcoin and I accumulate a billion {dollars} of Bitcoin, I’ve a billion {dollars} of digital capital. What can I do with it? I can situation digital credit score,” he mentioned.

In Saylor’s mannequin, the fairness of a agency that repeatedly performs this cycle turns into “digital fairness,” engineered to outperform the underlying asset by conservative leverage and tenor administration: “If I need to create an organization that’s going to carry out 2x Bitcoin, I take the Bitcoin, I situation Bitcoin-backed credit score… I create digital fairness and the digital fairness outperforms the underlying capital asset.”

He insists the aggressive set is just not different Bitcoin treasuries however the huge stock of Twentieth-century credit score—mortgage, company, and sovereign—priced off low or repressed yields and infrequently secured by depreciating or illiquid collateral. “What they’re competing in opposition to is the present credit score devices within the capital market,” Saylor mentioned.

The pitch to savers is equally blunt: the “higher financial institution” is one which strips out length and pays an expansion over the fiat established order, funded by over-collateralized Bitcoin. He sketched it in operational phrases: elevate fairness, purchase Bitcoin, then promote short-duration, BTC-secured credit score “that simply strips the length to 1 month… and provides individuals 500 foundation factors extra yield than the risk-free price within the capital market the place you’re promoting the credit score.”

The dimensions he envisions is just not modest. Saylor walked by jurisdictions the place monetary repression or chronically low coverage charges amplify the unfold, arguing that mature markets with suppressed yields are the ripest soil for “pure-play digital credit score issuers.” Switzerland and Japan had been his canonical examples.

The aspiration, nevertheless, is international. “What if there’s 100 trillion {dollars} of digital credit score and… 200 trillion value of digital capital,” he requested, emphasizing that such a construction might stay over-collateralized slightly than drift into fractional banking. He additionally pressed the geopolitical logic: company treasuries and well-capitalized exchanges, miners, and custodians turn into the “first line of financial protection,” lobbying and normalizing Bitcoin inside home rule-sets the best way incumbent industries do. “If you wish to win the financial warfare you want the establishments that management all of the capital and… the assist of the federal government,” he mentioned.

Bitcoin Treasury Firms Will Be Banks

Saylor was express that company adoption is already compounding. He traced the cohort of publicly traded steadiness sheets holding BTC from a single agency in 2020—MicroStrategy—to “two or three… then 10… then 20… then 40… a couple of yr in the past there have been 60… three months in the past there have been 120 and proper now there’s greater than 180,” with the goal trajectory transferring from “100 to a thousand to 10,000 to 100,000.” He blended that diffusion story with the platform thesis—Bitcoin constructed natively into iOS, Android, Home windows, and client {hardware}—arguing that operating-system-level assist is the opposite clear sign that “digital power” has fused with the material of commerce.

Requested in regards to the distributional critique—that firms crowd out people—Saylor inverted the premise, claiming institutional flows have largely accrued to early holders. “After we received concerned, Bitcoin was buying and selling $9,000 a coin… in the present day Bitcoin’s $115,000,” he mentioned, attributing a lot of the appreciation to company and ETF demand. “That signifies that 93% of the acquire… went to the people that owned the Bitcoin earlier than the companies received concerned.”

The rhetoric could be martial—Saylor calls it a “protocol warfare”—however his operational self-discipline hinges on avoiding the traps that wrecked miners within the final cycle. Quick and costly liabilities layered onto depreciating {hardware} was, in his view, the deadly mismatch. The treasury archetype he champions favors mid-to-longer length capital buildings tied to an appreciating base asset. “If you happen to take a mid-duration or long-duration mortgage and purchase an asset appreciating 30 to 60% a yr, you’ll in all probability be positive,” he mentioned, dismissing M&A diversification as value-destructive opacity in comparison with the “good accomplice” of merely shopping for extra BTC at “one occasions income.”

Saylor On US Coverage

Saylor additionally pushed the coverage and infrastructure horizon, predicting a phased legitimization of tokenized property whereas stressing that the “biggest regulatory readability” stays BTC’s standing as a digital commodity that may sit on steadiness sheets and collateralize credit score. He summarized the brand new political posture in Washington as supportive of constructing the US a “international Bitcoin superpower”—not by nationalizing miners or buying fairness stakes, however by mainstreaming custody, collateralization, lending, operating-system integration, and tax remedy. “They need the finance corporations in the US to cleared the path… and the finance corporations in the US to cleared the path in digital property and digital capital and Bitcoin adoption,” he mentioned.

For a neighborhood accustomed to debating halvings, hash price, or on-chain heuristics, Saylor’s endgame facilities elsewhere: indexes, coupons, tenors, and yield curves—all re-denominated atop a brand new financial base. It’s a company finance thesis at Bitcoin’s core. And it doubles as a provocation to boards and CFOs in each forex regime: “For each firm on the earth in any capital market, they’re all the time higher off to purchase Bitcoin as their capital asset,” he mentioned. The remainder is execution at scale. “Get to a trillion {dollars} of collateral rising 30% a yr, be issuing $100 billion of credit score a yr, rising 20, 30% a yr,” Saylor concluded. “We’re constructing a greater financial institution.”

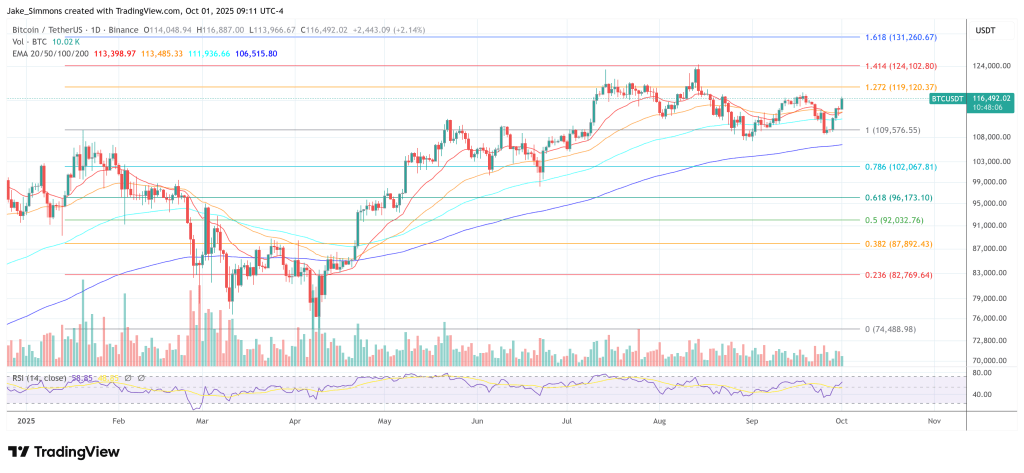

At press time, Bitcoin traded at $116,492.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.