Key Highlights:

- Bitwise CEO Hunter Horsley predicts that credit score and borrowing in crypto might explode within the subsequent few months.

- Turning U.S. shares into tokens might let folks borrow on the blockchain even with small quantities of shares. This can make credit score a lot simpler to entry.

- Business knowledge confirms robust progress in on-chain lending and staking.

The crypto business has survived numerous waves of innovation, from the rise of Bitcoin and Ethereum to decentralized finance taking up, NFTs, and the anticipated surge of spot exchange-traded funds (ETFs). However in response to Bitwise CEO Hunter Horsley, the following large shift won’t come from these areas, however it might come from crypto credit score and borrowing.

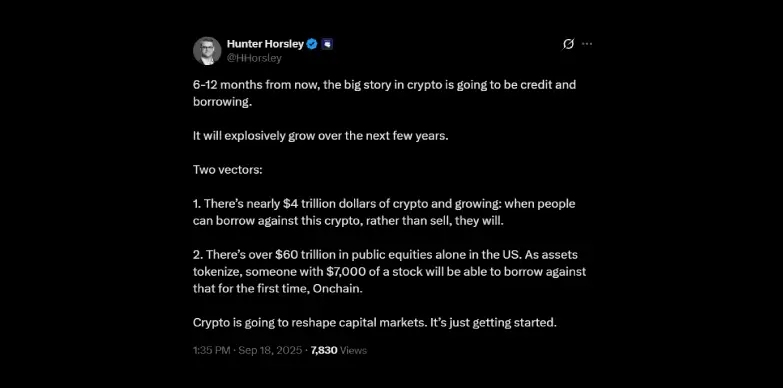

Talking on the evolving function of digital belongings in conventional capital markets, Horsley projected that credit score markets constructed on crypto and tokenized belongings will see explosive progress within the subsequent few years. He additionally recommended that this transformation might come by way of throughout the subsequent 6-12 months and it’ll reshape how crypto market works.

The Two Vectors of Development

Horsley in his put up on X (previously often called Twitter) highlighted two main forces that may be converging within the close to future:

The primary cause is the scale of the crypto market. As of now, there’s nearly $4 trillion price of cryptocurrency in circulation worldwide and as we will see the quantity is rising daily. Resulting from this progress, many buyers don’t need to promote their cash, however they nonetheless want money typically.

In line with the Bitwise CEO, borrowing in opposition to crypto makes extra sense as a result of as an alternative of promoting cash, folks can as an alternative use them as collateral for loans. On this method, the buyers get the cash that they need, and their funding in crypto additionally stays intact. This whole course of can be tax-friendly, as a result of promoting tokens normally results in larger taxes for the buyers.

The second cause is the large worth of conventional belongings. Simply the U.S. inventory market alone is price round $60 trillion. As this idea of tokenization grows (that means shares, bonds, and different real-world belongings get placed on blockchains), it should create new methods for folks to borrow cash.

Horsley defined that even somebody who owns simply $7,000 price of inventory might quickly use it as collateral to borrow, straight on the blockchain. This case turns into vital as a result of it has the capability to open up credit score entry to small buyers who usually should not have sufficient collateral or connections to large monetary establishments. Briefly, it should make borrowing simpler and extra inclusive.

Borrowing and Staking: The Knowledge Behind Crypto’s Credit score Revolution

Latest analysis and market knowledge add weight to what the Bitwise CEO is predicting. The numbers present that borrowing and staking in crypto are certainly rising quick, although there are some ups and downs alongside the best way.

For instance, in response to Galaxy.com, in Q2 2025, crypto lending hit $53 billion, which was a rise of $11.4 billion (which is about 27%) in only one quarter. This progress has come from DeFi platforms like Aave and Compound) and CeFi platforms. By mid-2025, borrowing on these platforms had reached document highs.

When you take a look at staking, it is usually booming. In line with fireblocks, by mid-2025, greater than $100 billion price of crypto was staked, all due to large buyers coming into the market and blockchain networks upgrading their system.

Different studies present that platforms like Aave, Compound, and Ethereum’s personal staking system are proving how mainstream crypto credit score and staking have gotten. All of this proof signifies that credit score, borrowing, and staking might be main forces in shaping the way forward for crypto which is in step with what the Bitwise CEO is predicting.

Challenges Forward

The highway forward is not going to be simple. Guidelines for tokenized shares and bonds are nonetheless not clear, and there are considerations concerning security in crypto lending, particularly after lots of the lending platforms like Celsius, Voyager, and BlockFi collapsed throughout the 2022-2023 downturn.

Regardless of there being challenges and important dangers, Bitwise CEO is optimistic and thinks that the world is prepared for a gentle progress forward.

Additionally Learn: Kalshi Launches KalshiEco to Enhance Prediction Market With Solana and Base