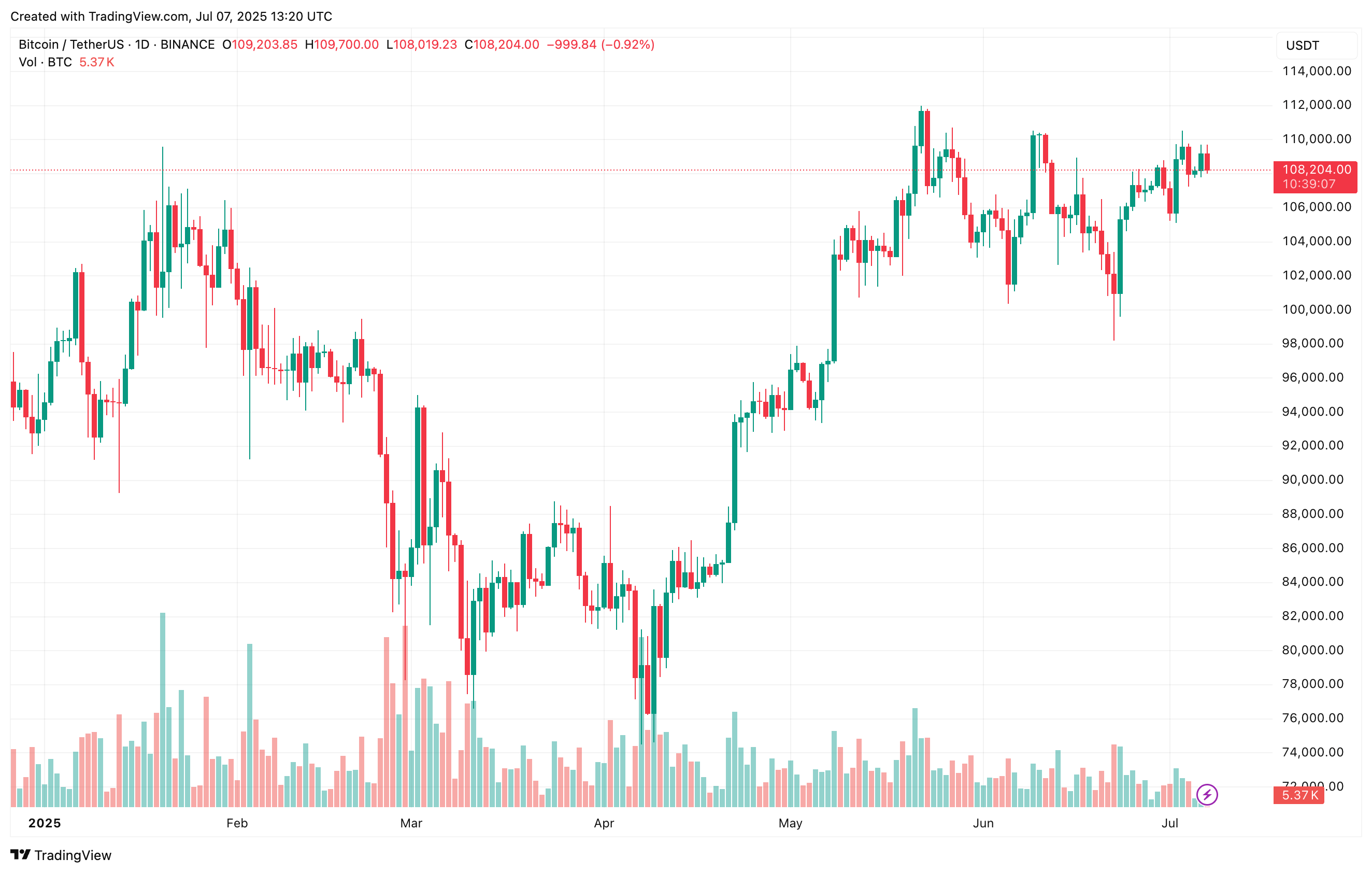

Bitcoin (BTC) is up 7% during the last two weeks, exhibiting indicators of power regardless of expectations that the US Federal Reserve (Fed) will preserve rates of interest unchanged at its upcoming July 30 assembly. Nevertheless, some indicators recommend that the market could also be getting into overheating territory.

Bitcoin Market Getting into Overheating Territory?

In response to a latest CryptoQuant Quicktake submit by contributor burakkesmeci, the Bitcoin Community Worth to Transaction (NVT) Golden Cross is on the rise. Importantly, this upward motion is starting to sign indicators of market overheating.

Associated Studying

For the uninitiated, the Bitcoin NVT Golden Cross is a technical indicator that compares short-term and long-term shifting averages of the NVT ratio to establish potential market tops or bottoms. When the short-term NVT crosses above the long-term common, it usually indicators that Bitcoin is turning into overvalued and will face a short-term correction.

Notably, this indicator has efficiently predicted three native tops up to now in 2025. The primary occurred on February 5, when the NVT Golden Cross hit 2.68 whereas BTC traded at $97,600, adopted by a 23.65% correction.

On March 24, the indicator peaked at 2.87 with BTC round $87,500, resulting in a subsequent correction of 16.06%. Most just lately – on June 16 – it rose to 2.21 with BTC buying and selling at $106,800, which was adopted by a 9.87% value dip.

Presently, the NVT Golden Cross stands at 1.98. Though it hasn’t crossed the important thing 2.2 threshold but, its upward trajectory means that market overheating may very well be brewing. The CryptoQuant analyst defined:

Breaking its earlier excessive is reasonably bullish and reveals momentum is constructing. If the metric crosses 2.2 once more, it might trace at a neighborhood prime. However don’t rush to exit – traditionally, the metric has stayed above 2.2 for a number of days.

In conclusion, burakkesmeci famous that whereas crossing the two.2 stage may recommend Bitcoin is heating up within the short-term, it may additionally sign a return of bullish momentum within the medium-term. That mentioned, the opinion on BTC’s short-term value trajectory is basically divided.

Analysts Cut up Over BTC Value Motion

The NVT Golden Cross means that BTC should still have room to rally earlier than hitting a possible native prime. Nevertheless, some analysts foresee a short-term pullback earlier than Bitcoin reaches new highs.

Associated Studying

For example, famous crypto analyst Chistian Chifoi described the present BTC value motion as a “misleading setup,” warning it might lure bulls earlier than a doable surge towards a brand new all-time excessive (ATH) of $160,000.

In the meantime, on-chain analytics agency Glassnode forecasts BTC’s short-term peak at $117,000. At press time, BTC trades at $108,204, down 0.1% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com