Merchants are leaning bullish on the gold futures worth, with the GC00 curve steepening, based on Correlation Economics.

Gold’s dip through the U.S.-China commerce battle earlier this yr wasn’t a flight from security—it was a byproduct of a stronger greenback and a broad threat rally that lifted the S&P 500 15% off its lows.

“Gold truly has properties — you should utilize gold for all types of issues. Individuals worth gold for the metallic. No one values bitcoin for the bitcoin; they worth it as a result of they consider that they’ll trade it for one thing else.”

— Peter Schiff, man who would commerce his spouse for gold

So what’s a greater hedge towards inflation: Bitcoin or gold? Reality be informed, neither shield you from inflation.

Everybody immediately is totally confused as to what inflation is. The issue is that in case you don’t perceive this straightforward level, you then’re not going to grasp the long-term worth of cryptocurrency, gold, and even shares.

Right here’s what it is best to know:

Crypto is NOT a Hedge In opposition to Inflation

Bitcoin and Ethereum aren’t insurance coverage insurance policies towards inflation—they’re bets towards fiat debasement.

Inflation isn’t nearly printing cash. It’s what occurs when provide chains fracture, wars get away, or demand outpaces manufacturing.

The Federal Reserve printing {dollars} doesn’t mechanically spike costs on the grocery retailer. What it does do is pump monetary property—shares, crypto, housing—as a result of that’s the place the liquidity lands.

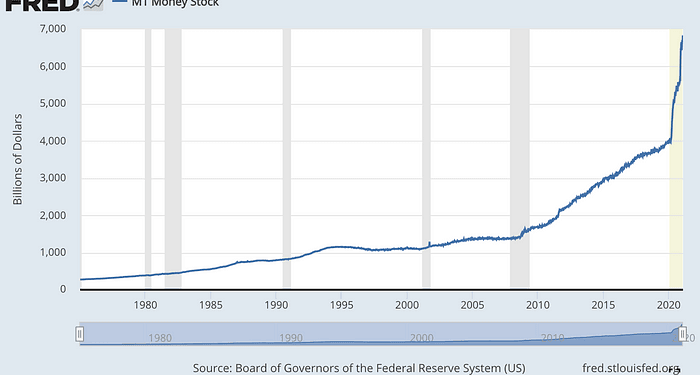

Certain, you shouldn’t print an excessive amount of cash — just like the Federal Reserve printing 1/4 of the overall provide of {dollars} ever— however the principle think about inflation isn’t the printing of cash, it’s the provision and demand of products.

They assume {that a} rampant inflation disaster will trigger the worth of gold to go up. This isn’t the case. In terms of out-of-control inflation, nothing can shield you.

Gold Is Value Barely Extra Than It Was 40 Years In the past

Bitcoin tends to maneuver with tech shares. So, for perspective, right here’s how a $1 funding in several asset courses again in 1802 would’ve performed out:

Gold is suitable as a complement to your inventory portfolio. That’s it. The one excuse for making it your main asset is by being schizophrenic with a hard-on for armageddon.

It’s most likely why Peter Schiff’s prime movies are “Refill this might get very ugly” or “We’ve by no means seen something like this” or “We’re about to endure a lot worse than I believed.”

So what about Bitcoin and Ethereum?

In a world the place inflation eats wages and financial savings earn lower than your native merchandising machine, crypto affords a counterweight.

Not as a result of it’s fashionable, however as a result of the highest cryptocurrencies like Bitcoin, Ethereum, SOL, SUI, and others don’t bend to coverage whims. Shortage is in-built. Provide is capped. And as extra individuals discover causes truly to make use of these networks, the stress solely builds—this time in the correct route.

In a world of unhinged financial uncertainty, together with a Federal Reserve that controls the financial system like a dictatorship and banks that promise you’ll personal nothing by 2030, it’s good to have a retailer of worth that may’t be debased.

That’s what crypto is. And that’s why it’s stronger than ever in the summertime of 2025.

EXPLORE: XRP Worth Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Merchants are leaning bullish on the gold futures worth, with the GC00 curve steepening, based on Correlation Economics.

- In a world the place inflation eats wages and financial savings earn lower than your native merchandising machine, crypto affords a counterweight.

The submit Is Gold Futures Worth A Higher Funding Than Bitcoin Now? appeared first on 99Bitcoins.