Bitcoin is agency when writing, floating increased and above $60,000. Even because the uptrend appeared labored and momentum waning, there are indicators that each one is effectively, no less than from the profitability angle.

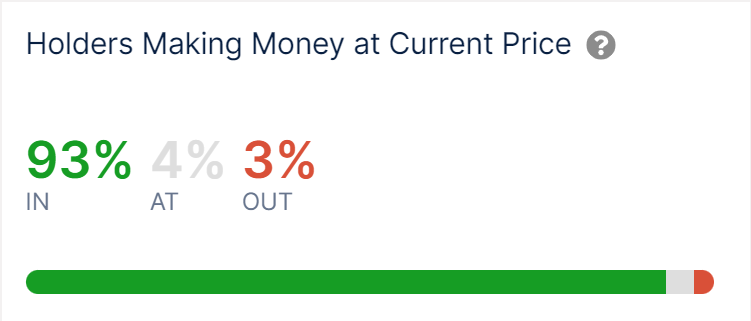

93% Of Bitcoin Addresses Are In The Cash

As of July 22, Bitcoin is steady and down roughly 8% from all-time highs of round $74,000. IntoTheBlock information confirmed that 93% of all addresses are within the inexperienced at spot charges.

If something, it’s a main restoration and a turnaround, particularly after the main sell-off of June and early July 2024, when costs plunged to as little as $53,500 earlier than bouncing off.

On the present valuation, a minority of BTC holders are within the crimson. These entities most definitely purchased at round $72,000 or all-time highs, anticipating costs to roar to $100,000.

Because it has turned out, Bitcoin dropped by as a lot as 21% from all-time highs to July 2024 lows earlier than discovering a reprieve. The sell-off additionally compelled some holders to exit at a loss.

The restoration to above $67,000 has helped restore confidence amongst BTC holders, particularly short-term holders (STHs). STHs are entities which have purchased BTC inside the final 155 days. When costs exceeded $63,000, holders inside this class started to develop into worthwhile, lowering the promoting strain.

Miners Accumulating BTC As Uptrend Confirmed

Curiously, as Bitcoin costs edge increased, it is usually rising that miners usually are not eager on promoting.

All through July, IntoTheBlock information revealed that miners had been aggressively accumulating. High mining farms like Mara Digital and Riot Blockchain gathered over 4,500 BTC within the final three weeks alone.

The constructive sentiment and expectations of BTC costs to edge increased have spilled over, impacting their inventory costs. Final week, IntoTheBlock information confirmed that MARA and RIOT shares rose by over 30%. Traders have endorsed these public mining companies, saying they’ll proceed increasing within the coming weeks.

On the similar time, it’s rising that entities holding no less than 1,000 BTC are quickly accumulating. By July 19, the quantity of BTC held by this cohort stood at a two-year excessive.

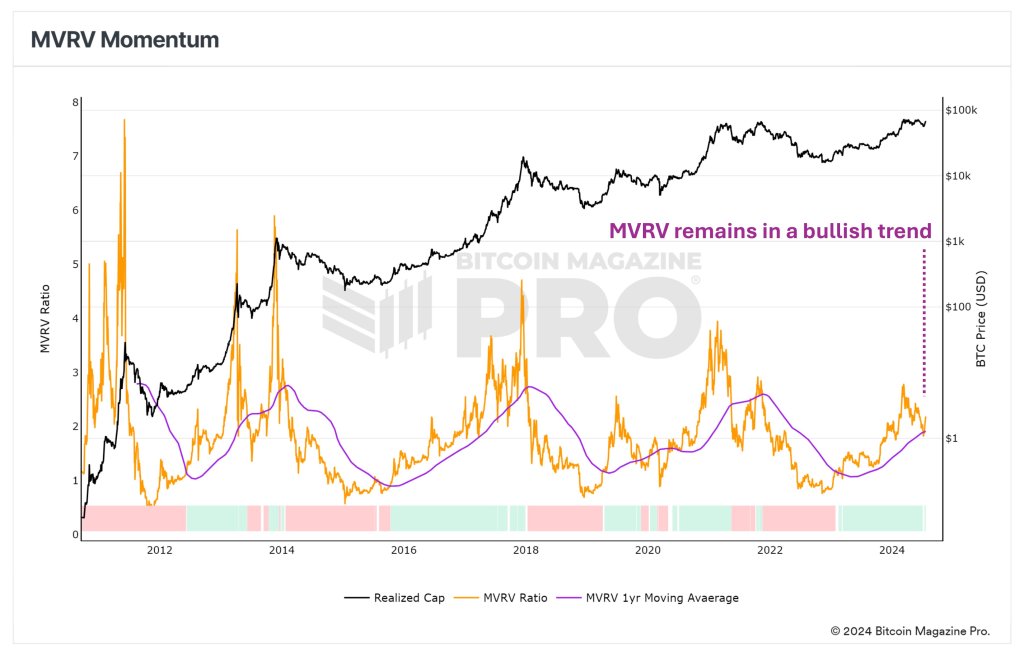

Amid this growth, the Bitcoin Market Worth to Realized Worth (MVRV) ratio, used to measure profitability, is rising. One analyst notes that as of July 22, the MVRV was bouncing off its one-year transferring common, confirming that the BTC uptrend is legitimate.

Characteristic picture from Canva, chart from TradingView